Weekly Market Report

For Week Ending September 24, 2022

For Week Ending September 24, 2022

Lumber prices plunged to their lowest level in more than two years following the Federal Reserve’s 75-basis-point rate hike last week, as soaring mortgage interest rates and the slowdown in the US housing market have caused lumber demand to cool rapidly this year. The Wall Street Journal reports lumber futures are down about one-third from a year ago and have fallen more than 70% from this year’s peak in March.

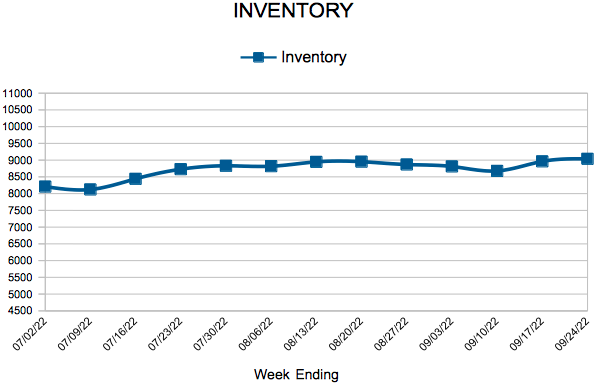

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 24:

- New Listings decreased 20.2% to 1,273

- Pending Sales decreased 29.4% to 983

- Inventory increased 0.4% to 9,039

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 5.7% to $369,900

- Days on Market increased 22.7% to 27

- Percent of Original List Price Received decreased 2.4% to 99.9%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

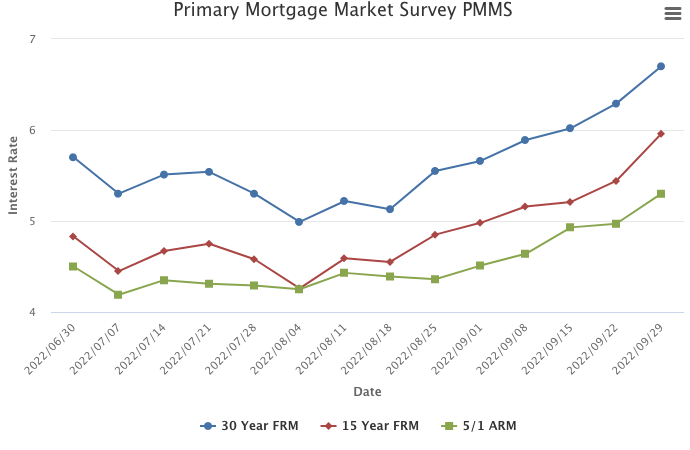

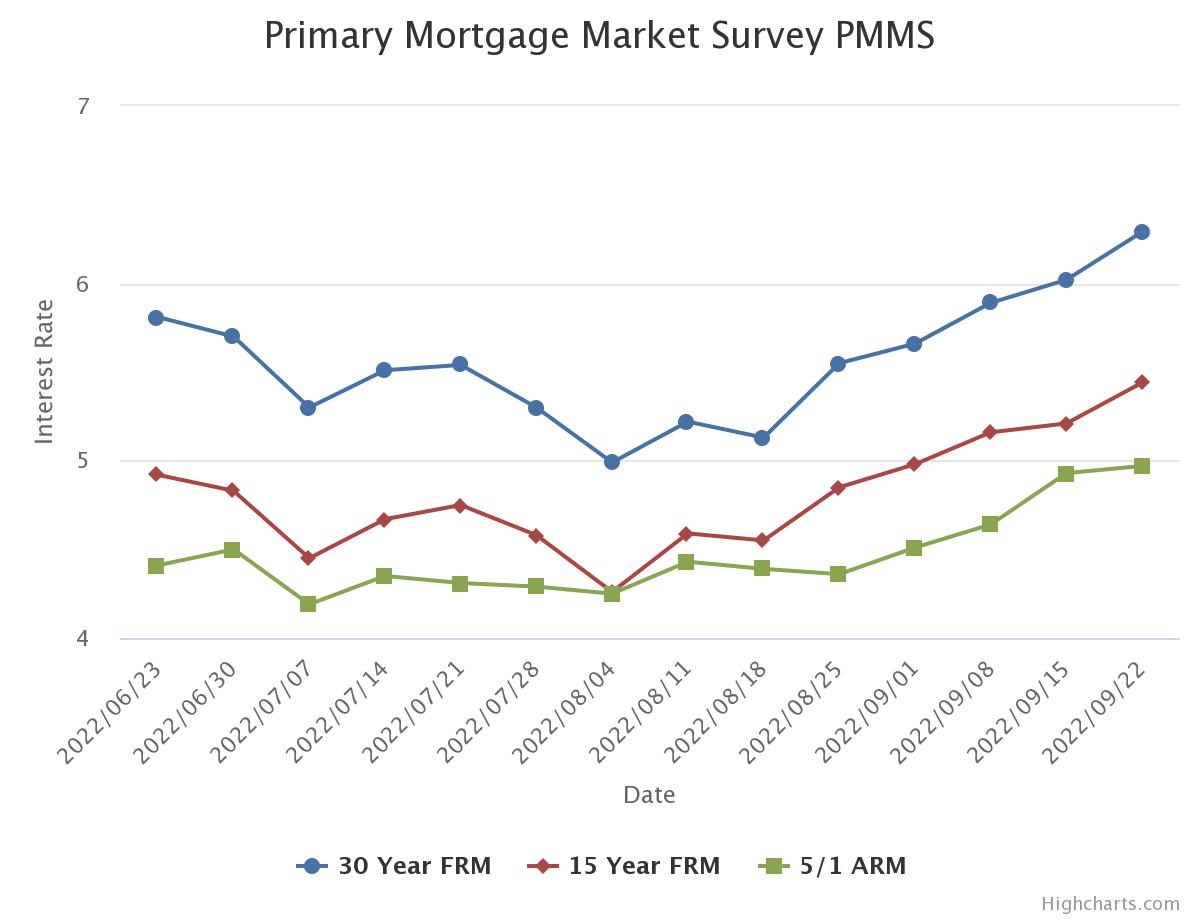

Mortgage Rates Rise for the Sixth Consecutive Week

September 29, 2022

The uncertainty and volatility in financial markets is heavily impacting mortgage rates. Our survey indicates that the range of weekly rate quotes for the 30-year fixed-rate mortgage has more than doubled over the last year. This means that for the typical mortgage amount, a borrower who locked-in at the higher end of the range would pay several hundred dollars more than a borrower who locked-in at the lower end of the range. The large dispersion in rates means it has become even more important for homebuyers to shop around with different lenders.

Information provided by Freddie Mac.

Existing Home Sales

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending September 17, 2022

For Week Ending September 17, 2022

Mortgage rates topped 6% the week ending 9/15, as hotter-than-expected inflation helped push rates to their highest level since 2008 amid growing recession concerns. According to Freddie Mac, mortgage rates are now double what they were this time last year, squeezing homebuyer budgets and causing home sales to slow under the weight of rising borrowing costs.

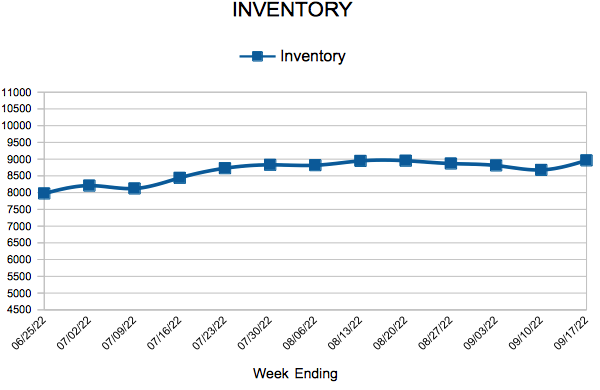

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING SEPTEMBER 17:

- New Listings decreased 20.5% to 1,424

- Pending Sales decreased 31.3% to 908

- Inventory increased 1.3% to 8,962

FOR THE MONTH OF AUGUST:

- Median Sales Price increased 5.7% to $369,900

- Days on Market increased 22.7% to 27

- Percent of Original List Price Received decreased 2.4% to 99.9%

- Months Supply of Homes For Sale increased 20.0% to 1.8

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Home price growth slows as market times rise and demand cools

- Median sales price was up just 5.6 percent to $369,750, the smallest gain since June 2020

- Buyer activity pulled back as pending sales fell 23.8 percent

- Homes took 26 days to sell, 18.2 percent longer than the 22 days last August

(September 16, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, both sales and listing activity were down in August while home price growth has slowed to its lowest level in two years but remains positive. Sellers also accepted lower offers as market times rose.

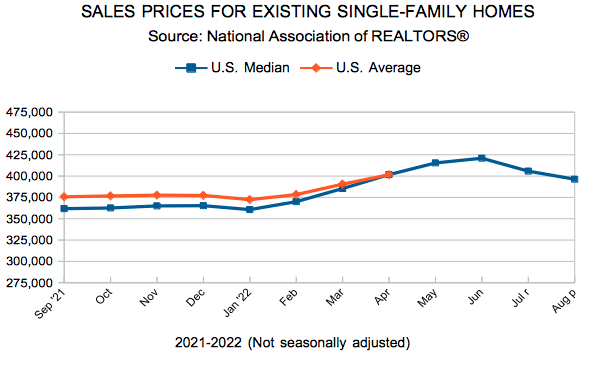

Inventory & Home Prices

The median home price in the Twin Cities reached $369,750 but the year-over-year growth rate is slowing. While prices are not falling, they’re not rising as quickly as they were. The 5.6 percent price growth in August is below the roughly 8.0 to 16.0 percent gains seen over the last two years. The deceleration in price growth likely reflects the pullback in demand caused by higher interest rates and economic uncertainty. Closed sales were down 20.3 percent in August compared to last year. Buyers also still face low inventory and limited options, although there’s evidence that’s changing.

“We’re seeing a less competitive landscape as the market has slowed given current interest rates,” said Denise Mazone, President of Minneapolis Area REALTORS®. “But the silver lining is that a less frenzied market could spell more inventory and opportunity for persistent buyers.”

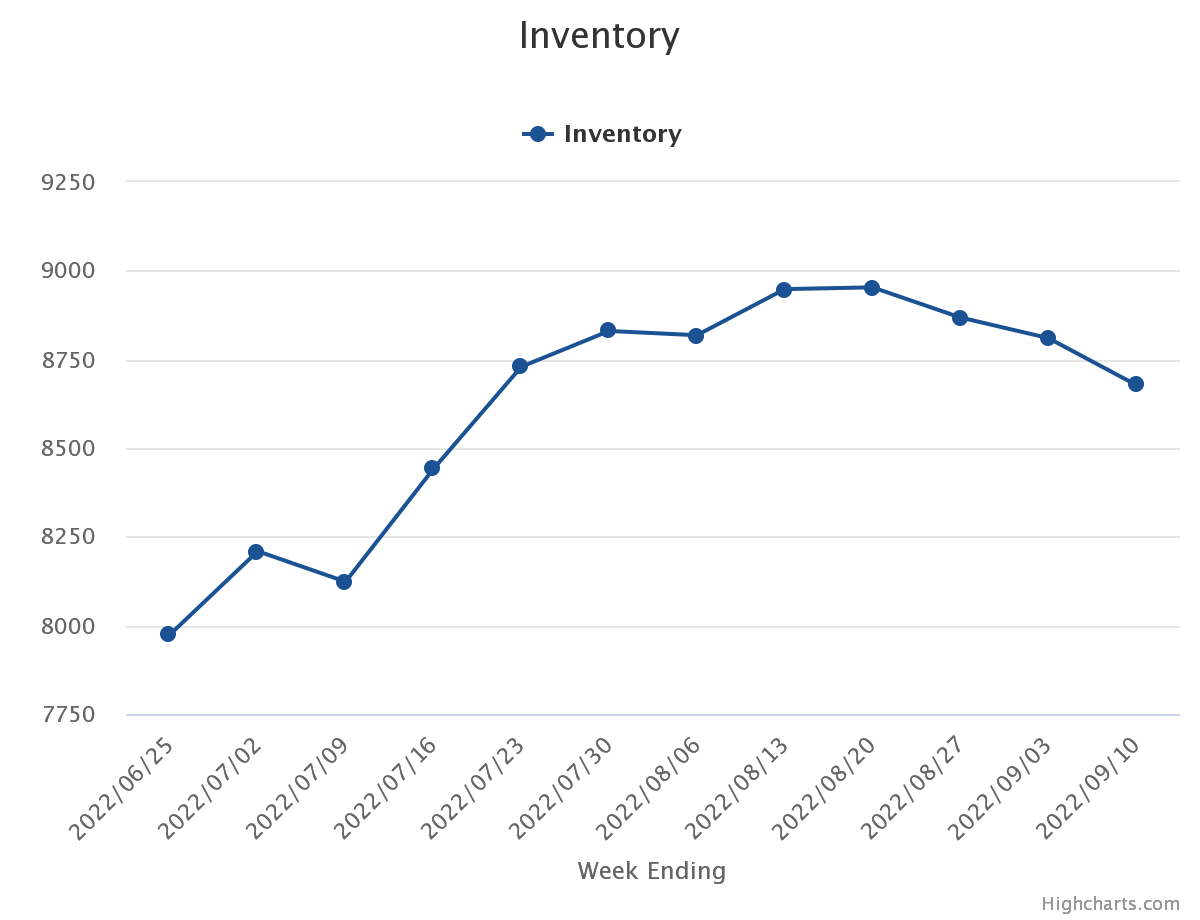

August ended with 8,552 homes for sale, nearly flat compared to last year. Although the region is still a seller’s market, the momentum has been shifting back towards a more balanced marketplace. Month’s supply of inventory rose 13.3 percent to 1.7 months.

Sales & Listings

Buyer activity has softened compared to recent years. This is partly caused by higher mortgage rates, but it also reflects demand being pulled forward (i.e. sales that would’ve occurred in 2022/23 instead took place in 2020/21). August showed 4,981 signed purchase agreements, 23.8 percent short of 2021 levels and the lowest August figure since 2014. But seller activity reached its lowest level since August 2012. The easing of demand has impacted how quickly homes sell. Homes remained on market for an average of 26 days, 18.2 percent longer than last August.

“Sellers may notice that their homes are taking an extra few days to go under contract,” according to Mark Mason, President of the Saint Paul Area Association of REALTORS®. “But nobody talks about the fact that even this slower pace is still fast historically. A cooling of red-hot demand and a less intense landscape means a more sustainable and accessible marketplace.”

Sellers listed 6,186 properties on the market, 19.9 percent fewer than last August. Many Baby Boomers are choosing to age in place and aren’t listing their homes. Some homeowners are reluctant to trade into a higher mortgage rate on a higher priced home given economic uncertainty. And, some sellers are choosing to wait given their lack of options once their home sells. The industry has also underbuilt housing for about 15 years, and it will take time to rise out of that deficit.

Location & Property Type

Market activity varies by area, price point and property type. New home sales fell 11.0 percent while existing home sales were down 20.3 percent. Single family sales fell 19.7 percent, condo sales declined 26.7 percent and townhome sales were down 17.4 percent. Sales in Minneapolis decreased 23.3 percent while Saint Paul sales fell 18.9 percent. Cities like Monticello, Golden Valley, and Orono saw the largest sales gains while Stillwater, Chanhassen, and Fridley had lower demand than last year.

August 2022 Housing Takeaways (compared to a year ago)

- Sellers listed 6,186 properties on the market, a 19.9 percent decrease from last August

- Buyers signed 4,981 purchase agreements, down 23.8 percent (5,568 closed sales, down 20.3 percent)

- Inventory levels dropped 1.3 percent to 8,552 units

- Month’s Supply of Inventory rose 13.3 percent to 1.7 months (4-6 months is balanced)

- The Median Sales Pricerose 5.6 percent to $369,750

- Days on Market rose 18.2 percent to 26 days, on average (median of 15 days, up 50.0 percent)

- Changes in Sales activity varied by market segment

- Single family sales decreased 19.7 percent; Condo sales were down 26.7 percent & townhouse sales fell 17.4 percent

- Traditional sales declined 20.0 percent; foreclosure sales fell 20.8 percent; short sales were up 40.0 percent (from 5 to 7)

- Previously owned sales decreased 20.3 percent; new construction sales declined 11.0 percent

The 30-year Fixed-Rate Mortgage Increased This Week

September 22, 2022

The housing market continues to face headwinds as mortgage rates increase again this week, following the 10-year Treasury yield’s jump to its highest level since 2011. Impacted by higher rates, house prices are softening, and home sales have decreased. However, the number of homes for sale remains well below normal levels.Freddie Mac Mortgage Rates

Inventory

- « Previous Page

- 1

- …

- 60

- 61

- 62

- 63

- 64

- …

- 102

- Next Page »