Weekly Market Report

For Week Ending October 9, 2021

For Week Ending October 9, 2021

As home prices have continued to soar, many borrowers are finding they must borrow more to afford the rising costs of homeownership. Applications for jumbo loans — those loans that exceed conventional conforming loan limits established by the Federal Housing Finance Agency — are on the rise, and could reach $550 billion this year, according to Bank of America researchers, the highest level since before the 2008 financial crisis.

In the Twin Cities region, for the week ending October 9:

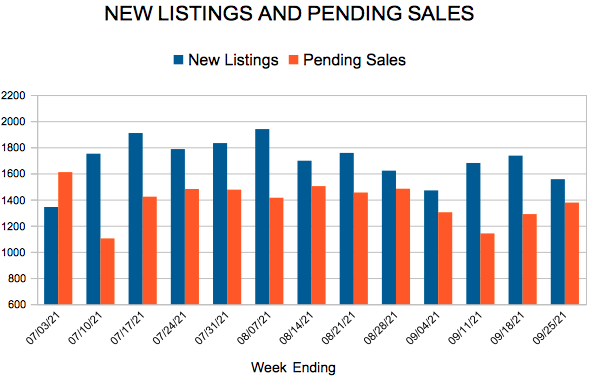

- New Listings decreased 16.4% to 1,476

- Pending Sales decreased 5.8% to 1,335

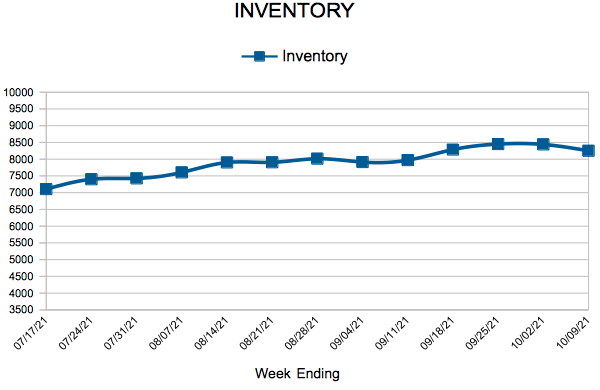

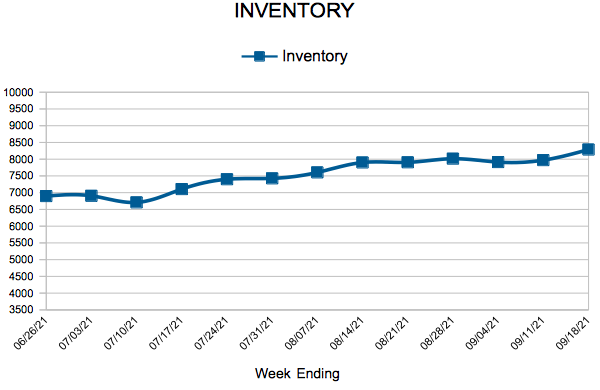

- Inventory decreased 15.6% to 8,251

For the month of September:

- Median Sales Price increased 10.0% to $341,000

- Days on Market decreased 37.8% to 23

- Percent of Original List Price Received increased 0.7% to 101.2%

- Months Supply of Homes For Sale decreased 21.1% to 1.5

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending October 2, 2021

For Week Ending October 2, 2021

Soaring sales prices have brought about significant gains in home equity during the pandemic, with the average annual equity increase for borrowers reaching $51,550 in the second quarter of the year, according to CoreLogic, which represents the largest average equity gain in more than 11 years. The rapid accumulation of equity may help homeowners who are behind on payments avoid foreclosure, allowing borrowers to access their equity and sell their home instead.

In the Twin Cities region, for the week ending October 2:

- New Listings decreased 13.6% to 1,547

- Pending Sales decreased 14.4% to 1,349

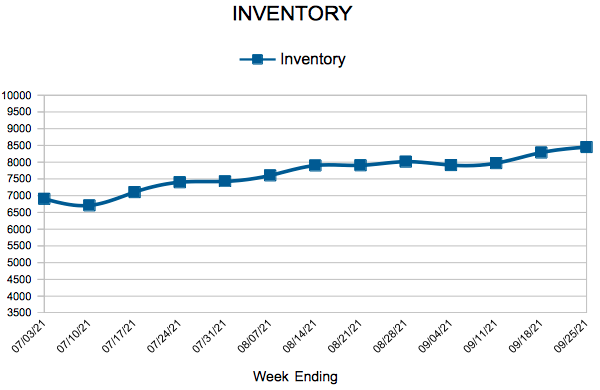

- Inventory decreased 14.8% to 8,440

For the month of August:

- Median Sales Price increased 11.1% to $350,000

- Days on Market decreased 43.6% to 22

- Percent of Original List Price Received increased 2.1% to 102.4%

- Months Supply of Homes For Sale decreased 26.3% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending September 25, 2021

For Week Ending September 25, 2021

The Federal Reserve announced this week that while it would keep its benchmark rate near zero, it was preparing to taper stimulus efforts put in place to combat the pandemic, including winding down its bond purchase program. Experts expect interest rates on mortgages, credit cards, car loans, and other consumer loans will rise as the Fed tapers its bond purchases. Looking long-term, The National Association of REALTORS® predicts the 30-year fixed-rate mortgage to rise to near 3.5% by mid-2022, about 60 basis points higher than they are today.

In the Twin Cities region, for the week ending September 25:

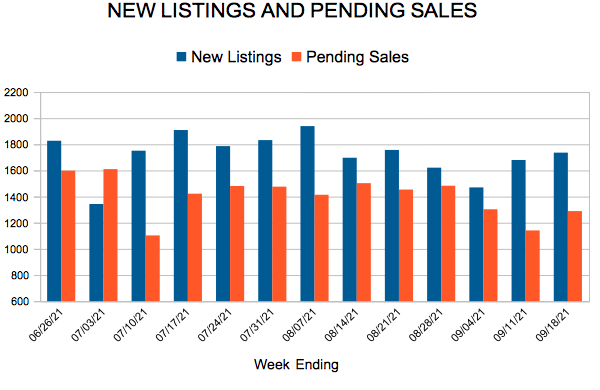

- New Listings decreased 15.1% to 1,556

- Pending Sales decreased 6.9% to 1,377

- Inventory decreased 14.3% to 8,451

For the month of August:

- Median Sales Price increased 11.1% to $350,000

- Days on Market decreased 43.6% to 22

- Percent of Original List Price Received increased 2.1% to 102.4%

- Months Supply of Homes For Sale decreased 26.3% to 1.4

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

New Listings and Pending Sales

Inventory

- « Previous Page

- 1

- …

- 81

- 82

- 83

- 84

- 85

- …

- 102

- Next Page »