For Week Ending July 24, 2021

For Week Ending July 24, 2021

Sales of new construction single-family homes fell to a 14-month low, dropping 6.6% in June compared to May, according to the Commerce Department, although sales of new homes remain 13.5% higher compared to a year ago. The recent decline in sales can be attributed to rising construction costs and building material prices, with these increases then passed on to consumers, and to labor and supply chain challenges, which have extended homebuilding timelines, frustrating buyers and further aggravating America’s housing shortage.

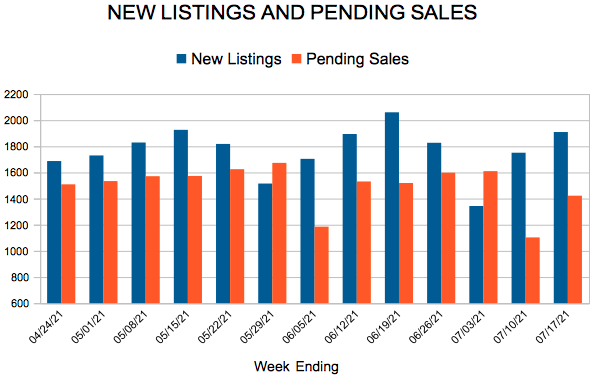

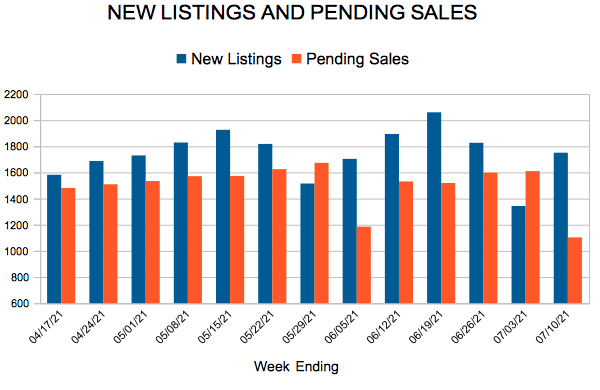

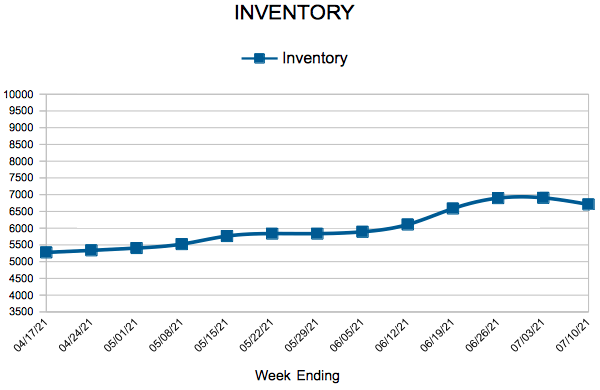

In the Twin Cities region, for the week ending July 24:

- New Listings decreased 3.3% to 1,786

- Pending Sales decreased 4.6% to 1,481

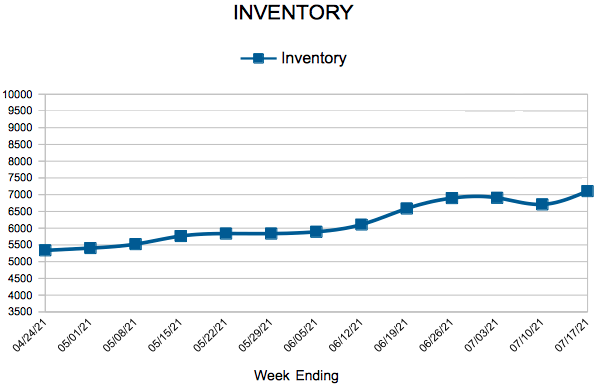

- Inventory decreased 25.9% to 7,400

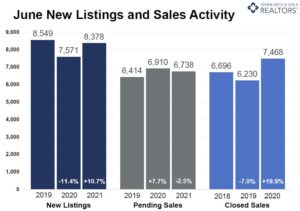

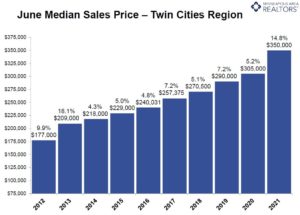

For the month of June:

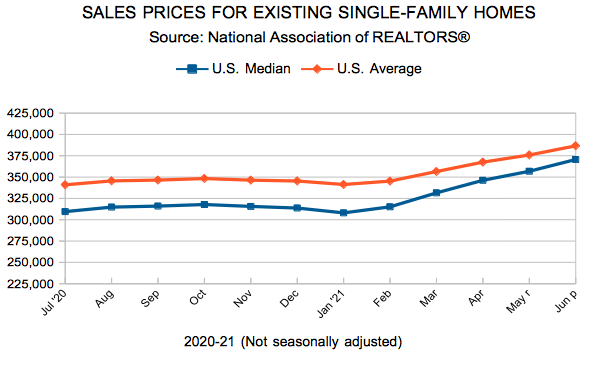

- Median Sales Price increased 14.8% to $350,000

- Days on Market decreased 52.4% to 20

- Percent of Original List Price Received increased 4.5% to 104.1%

- Months Supply of Homes For Sale decreased 42.9% to 1.2

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.