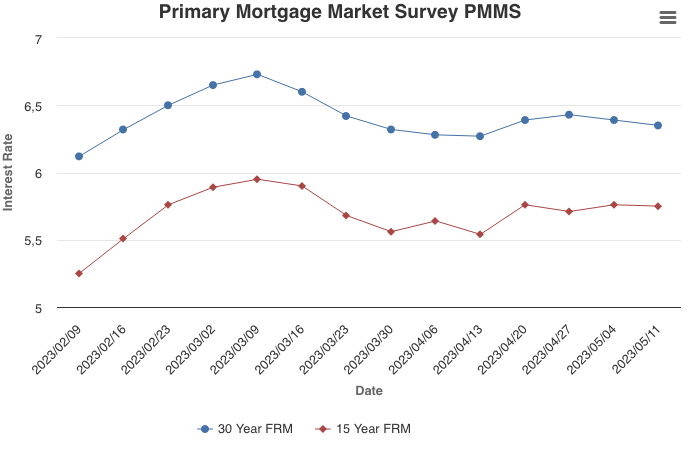

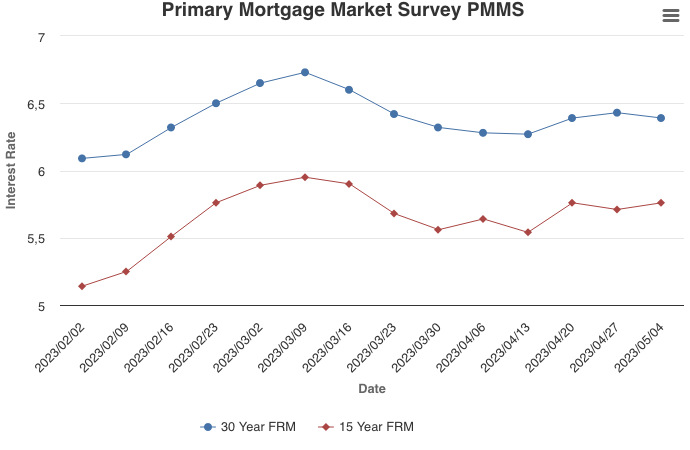

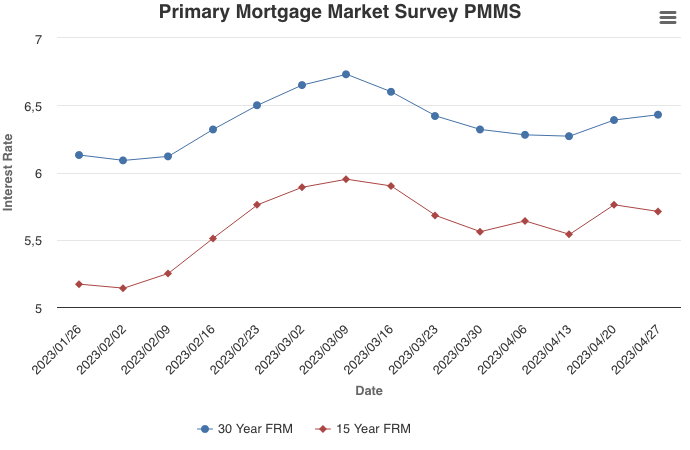

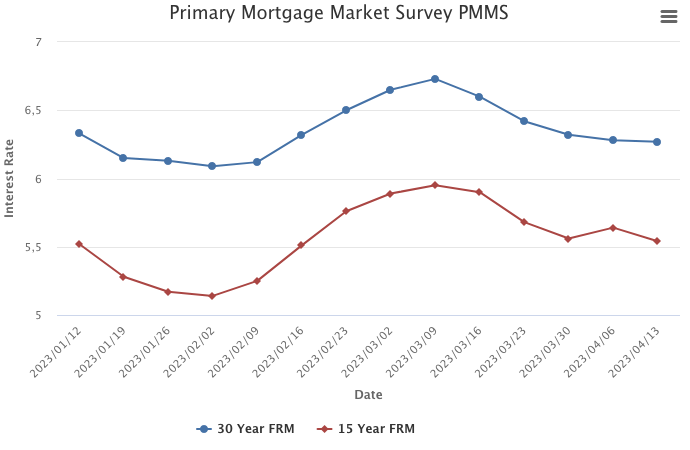

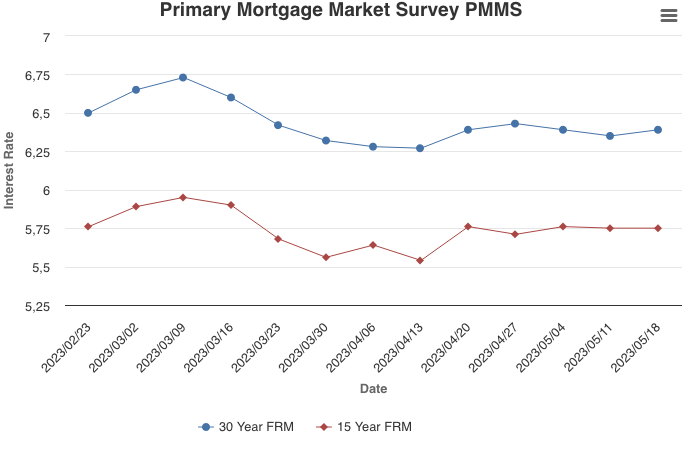

May 18, 2023

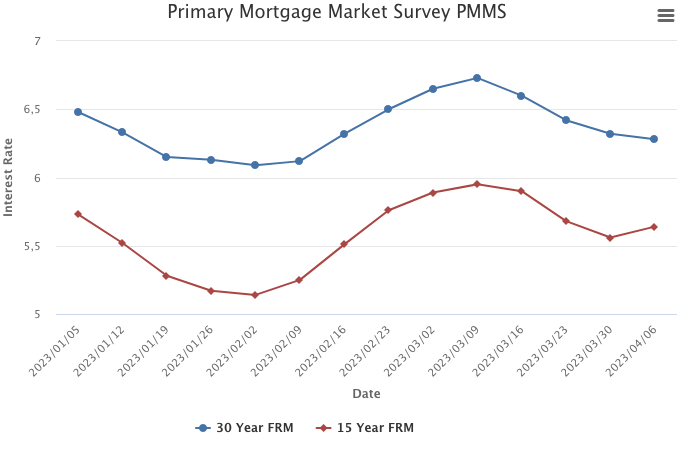

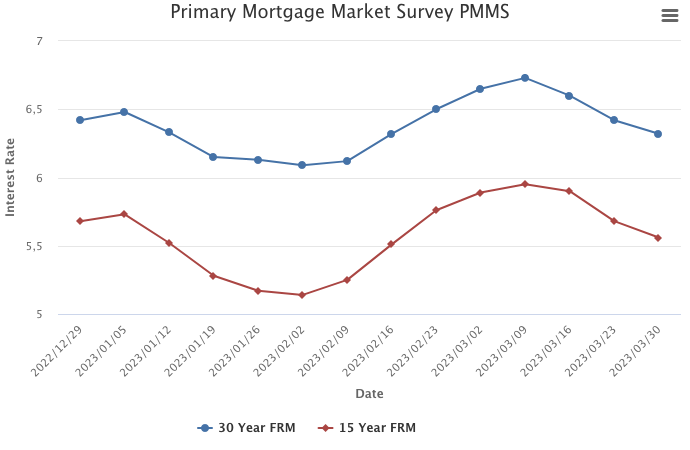

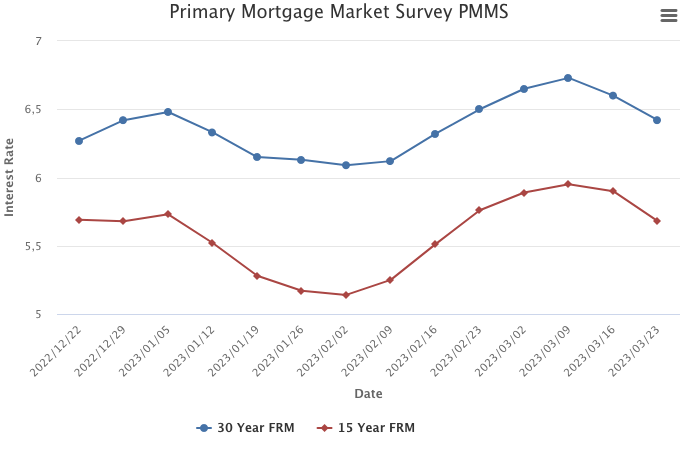

The 30-year fixed-rate mortgage averaged 6.39 percent this week, as economic crosscurrents have kept rates within a ten-basis point range over the last several weeks. After the substantial slowdown in growth last fall, home prices stabilized during the winter and began to modestly rise over the last few months. This indicates that while affordability remains a hurdle, homebuyers are getting used to current rates and continue to pursue homeownership.

Information provided by Freddie Mac.