September 22, 2022

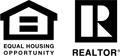

The housing market continues to face headwinds as mortgage rates increase again this week, following the 10-year Treasury yield’s jump to its highest level since 2011. Impacted by higher rates, house prices are softening, and home sales have decreased. However, the number of homes for sale remains well below normal levels.Freddie Mac Mortgage Rates

Mortgage Rates Continue to Move Up

September 1, 2022

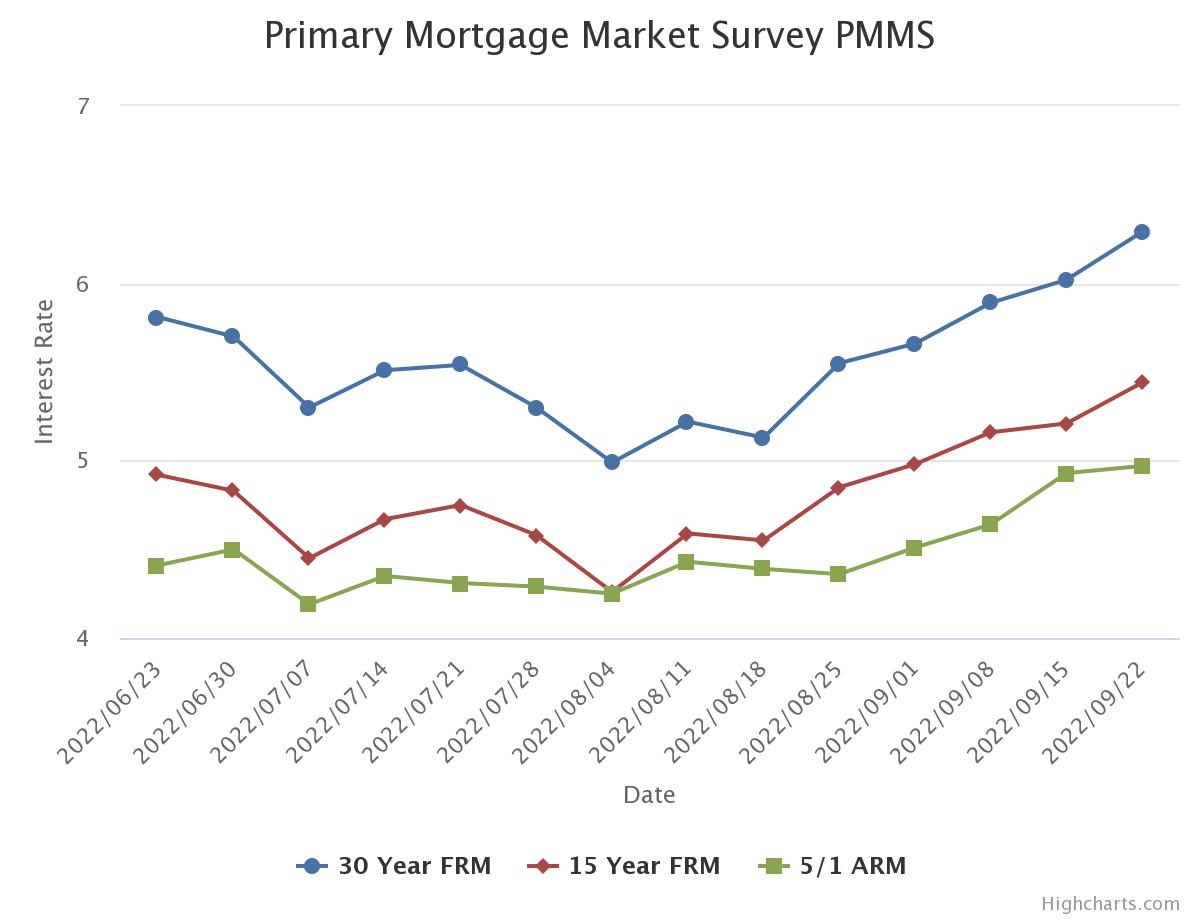

The market’s renewed perception of a more aggressive monetary policy stance has driven mortgage rates up to almost double what they were a year ago. The increase in mortgage rates is coming at a particularly vulnerable time for the housing market as sellers are recalibrating their pricing due to lower purchase demand, likely resulting in continued price growth deceleration.

July Monthly Skinny Video

Mortgage Rates Increase

August 25, 2022

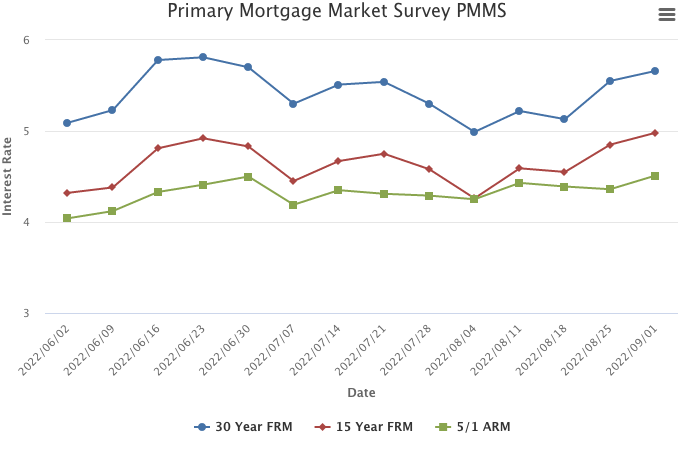

The combination of higher mortgage rates and the slowdown in economic growth is weighing on the housing market. Home sales continue to decline, prices are moderating, and consumer confidence is low. But, amid waning demand, there are still potential homebuyers on the sidelines waiting to jump back into the market.

Information provided by Freddie Mac.

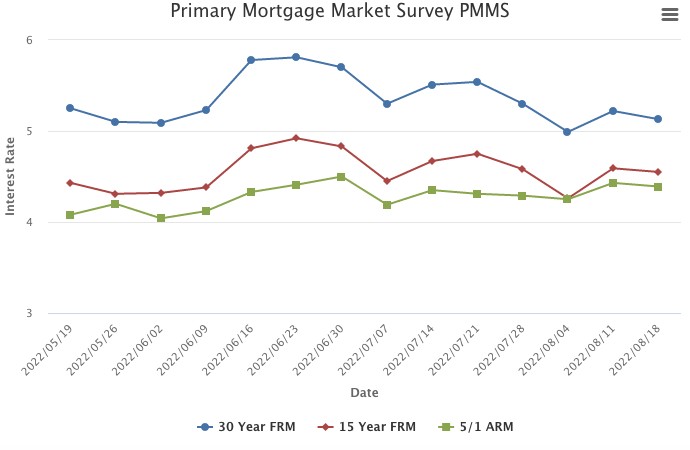

Mortgage Rates Revert from Last Week

August 18, 2022

Inflation appears to be beyond its peak, which has stopped the rapid increase in mortgage rates that the housing market was experiencing earlier this year. The market continues to absorb the cumulative impact of the large price and rate increases that led to a plunge in affordability. As a result, over the rest of the year purchase demand likely will continue to drag, supply will modestly increase, and home price growth will decelerate.

Information provided by Freddie Mac.

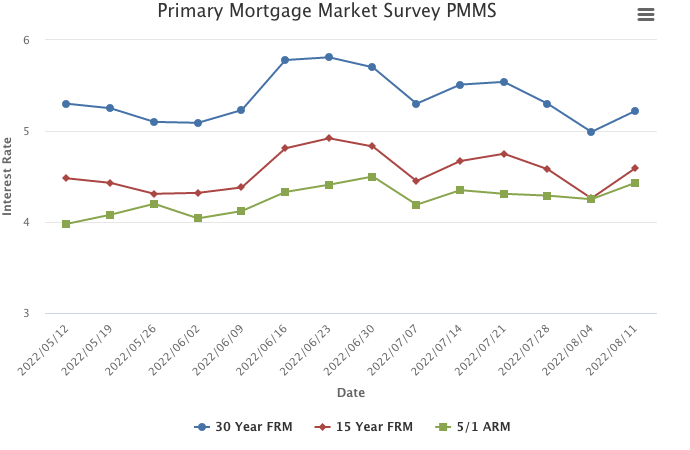

Mortgage Rates Jump Up

August 11, 2022

The 30-year fixed-rate went back up to well over five percent this week, a reminder that recent volatility remains persistent. Although rates continue to fluctuate, recent data suggest that the housing market is stabilizing as it transitions from the surge of activity during the pandemic to a more balanced market. Declines in purchase demand continue to diminish while supply remains fairly tight across most markets. The consequence is that house prices likely will continue to rise, but at a slower pace for the rest of the summer.

Information provided by Freddie Mac.

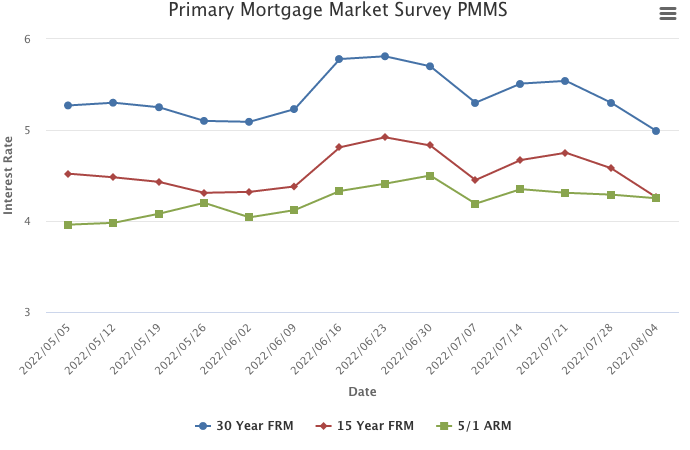

Mortgage Rates Drop Below Five Percent

August 4, 2022

Mortgage rates remained volatile due to the tug of war between inflationary pressures and a clear slowdown in economic growth. The high uncertainty surrounding inflation and other factors will likely cause rates to remain variable, especially as the Federal Reserve attempts to navigate the current economic environment.

Information provided by Freddie Mac.

Mortgage Rates Continue to Fluctuate

July 28, 2022

Purchase demand continues to tumble as the cumulative impact of higher rates, elevated home prices, increased recession risk, and declining consumer confidence take a toll on homebuyers. It’s clear that over the past two years, the combination of the pandemic, record low mortgage rates, and the opportunity to work remotely spurred greater demand. Now, as the market adjusts to a higher rate environment, we are seeing a period of deflated sales activity until the market normalizes.

Information provided by Freddie Mac.

June Monthly Skinny Video

As existing home sales continue to soften nationwide, housing supply is slowly improving, with inventory up for the second straight month.

Mortgage Rates Continue to Inch Up

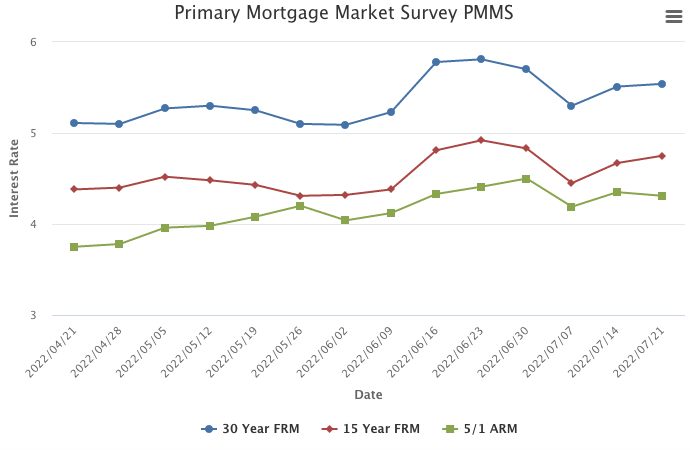

July 21, 2022

The housing market remains sluggish as mortgage rates inch up for a second consecutive week. Consumer concerns about rising rates, inflation and a potential recession are manifesting in softening demand. As a result of these factors, we expect house price appreciation to moderate noticeably.

Information provided by Freddie Mac.

- « Previous Page

- 1

- …

- 13

- 14

- 15

- 16

- 17

- …

- 21

- Next Page »