Mortgage interest rates ticked a bit higher in February, but remain below their February 2020 levels.

January Monthly Skinny Video

A robust increase in housing starts in December points to an active year for new construction, but higher material costs, especially lumber, and a limited supply of buildable lots will temper the number of new units.

December Monthly Skinny Video

December is normally one of the slowest months of the year, but strong buyer demand across most segments of the market, buoyed by near record-low interest rates, continues to drive a healthy sales pace in the face of a new wave of COVID-19 infections and a softening job market.

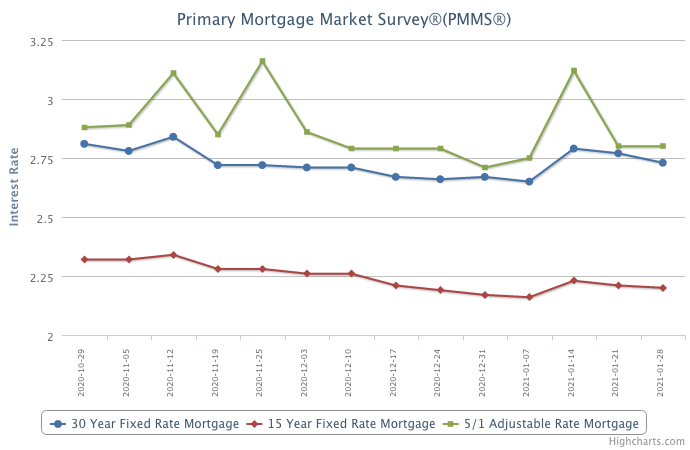

Mortgage Rates Move Down

January 28, 2021

As the market reacts to a new administration in Washington and COVID-19 driven economic malaise, mortgage rates continued to decrease this week, just slightly. Even as house prices increase at the fastest rate we’ve seen in years, competition to buy is strong given the low inventory that exists across the country. The fact that there are not enough homes to meet demand is going to be an ongoing issue for the foreseeable future.

Information provided by Freddie Mac.

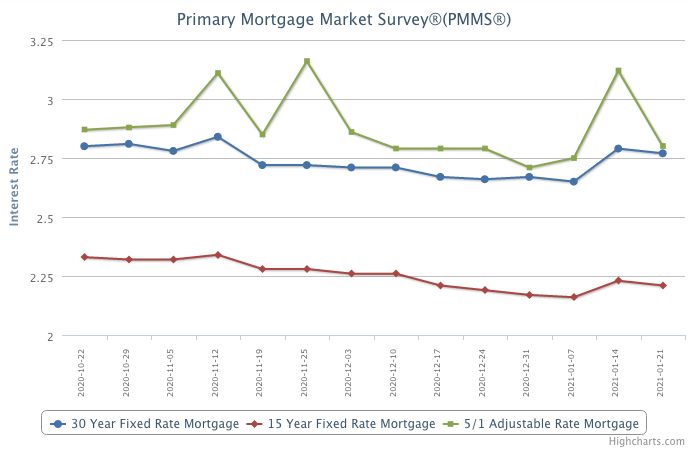

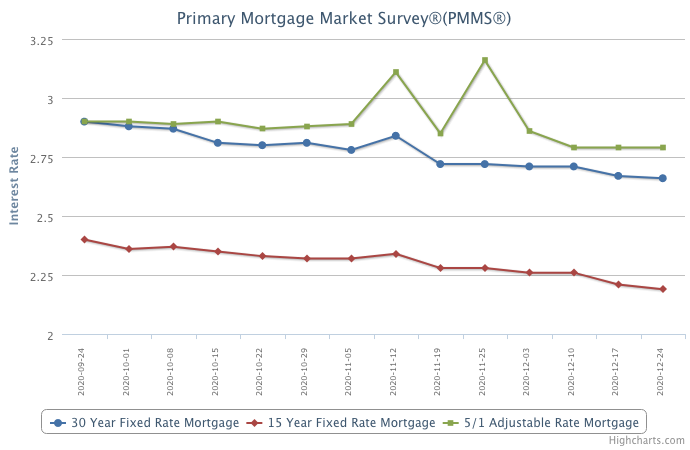

Mortgage Rates Move Slightly

January 21, 2021

Mortgage rates have hovered near historic lows for almost a year, fueling purchase and refinance activity amid a global health crisis. We’re now seeing rates fluctuate a bit as political and economic factors drive Treasury yields higher. However, we forecast rates to remain relatively low this year as the Federal Reserve keeps interest rates anchored near zero for a longer period of time, if needed until the economy rebounds.

Information provided by Freddie Mac.

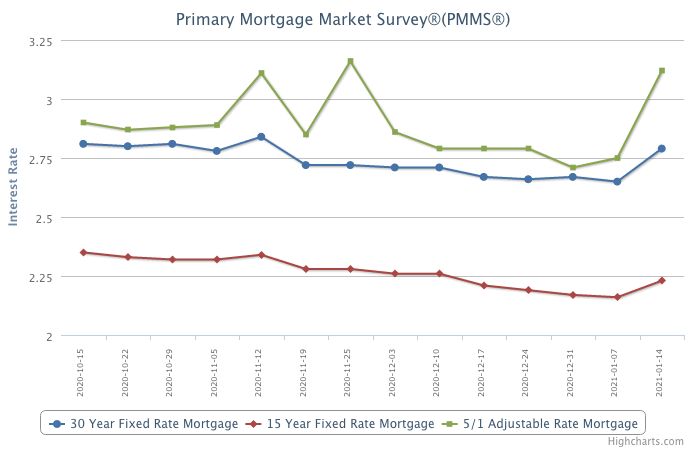

Mortgage Rates Tick Up

January 14, 2021

As Treasury yields have risen, it is putting pressure on mortgage rates to move up. While mortgage rates are expected to increase modestly in 2021, they will remain inarguably low, supporting homebuyer demand and leading to continued refinance activity. Borrowers are smart to take advantage of these low rates now and will certainly benefit as a result.

Information provided by Freddie Mac.

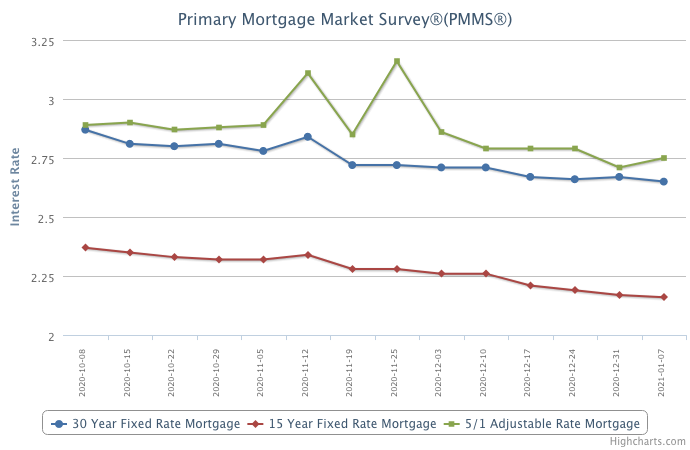

Mortgage Rates Hit a New Record Low the First Week of 2021

January 7, 2021

A new year, a new record low mortgage rate. Despite a full percentage point decline in rates over the past year, housing affordability has decreased because these low rates have been offset by rising home prices. However, the forces behind the drop in rates have been shifting over the last few months and rates are poised to rise modestly this year. The combination of rising mortgage rates and increasing home prices will accelerate the decline in affordability and further squeeze potential homebuyers during the spring home sales season.

Information provided by Freddie Mac.

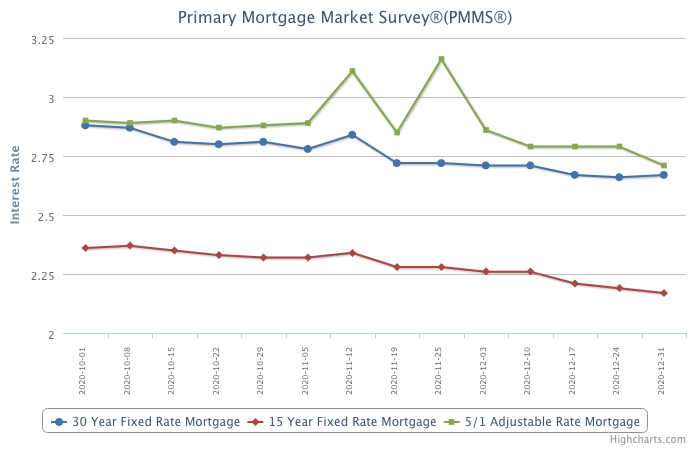

Mortgage Rates Remain Near Record Low Heading Into 2021

December 31, 2020

All eyes have been on mortgage rates this year, especially the 30-year fixed-rate, which has dropped more than one percentage point over the last twelve months, driving housing market activity in 2020. Heading into 2021 we expect rates to remain flat, potentially rising modestly off their record low, but solid purchase demand and tight inventory will continue to put pressure on housing markets as well as house price growth.

Information provided by Freddie Mac.

Mortgage Rates Hit Another Record Low

December 24, 2020

The housing market is poised to finish the year strong as low mortgage rates continue to fuel homebuyer demand and refinance activity. Moving into 2021, we expect rates to hold steady but the key driver in the near term will be the trajectory of the COVID-19 pandemic and the execution of the vaccine.

Information provided by Freddie Mac.

November Monthly Skinny Video

Showing activity remains higher than the same period a year ago across most of the country, suggesting that strong buyer demand is likely to continue into what is typically the slowest time of year.