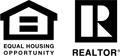

Mortgage Rates Hold Steady Heading into the Thanksgiving Holiday

November 25, 2020

Mortgage rates remain at record lows and while that has fueled a refinance boom, it’s been driven mainly by higher income borrowers. With about 20 million borrowers eligible to refinance, lower-and middle-income borrowers are leaving money on the table by not taking advantage of low rates. On the homebuying side, demand continues to surge, and it has created a seller’s market where inventory is at a record low and home prices are rising, beginning to offset the benefits of the low rates.

Information provided by Freddie Mac.

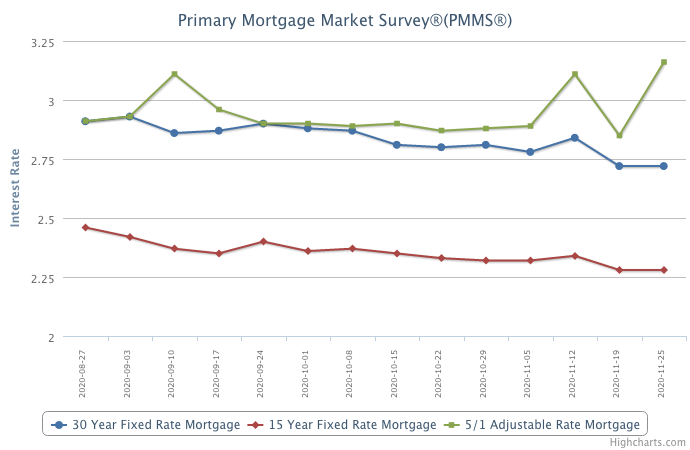

Mortgage Rates Drop, Hitting a Record Low for the Thirteenth Time this Year

November 19, 2020

Weaker consumer spending data, which accounts for the majority of economic growth, drove mortgage rates to a new record low. While economic growth remains unstable, strong housing demand continues to have a domino effect on many other segments of the economy.

Information provided by Freddie Mac.

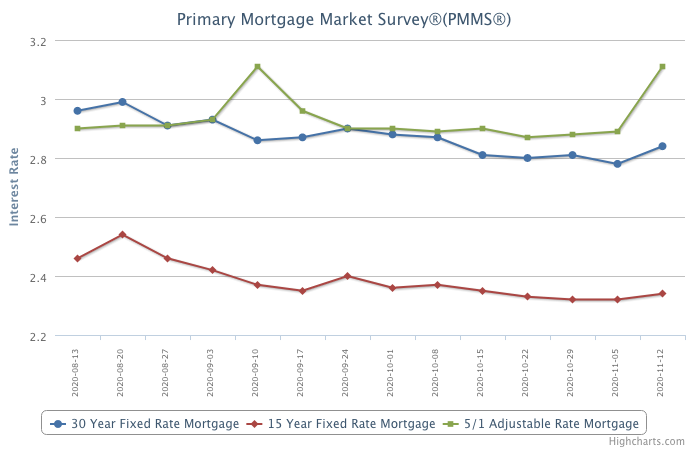

Mortgage Rates Rise

November 12, 2020

Mortgage rates jumped this week as a result of positive news about a COVID-19 vaccine. Despite this rise, mortgage rates remain about a percentage point below a year ago and the low rate environment is supportive of both purchase and refinance demand. Heading into late fall, the housing market continues to grow and buttress the economy.

Information provided by Freddie Mac.

Mortgage Rates Decrease Again

November 5, 2020

Mortgage rates hit another record low, the twelfth time this year, due to economic and political ambiguity. Despite the uncertainty that we’ve all experienced this year, the housing market, buoyed by low rates, continues to be a bright spot.

Information provided by Freddie Mac.

- « Previous Page

- 1

- …

- 21

- 22

- 23