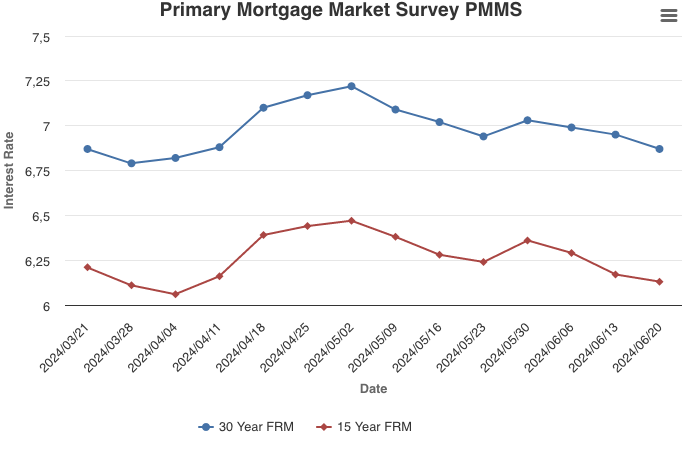

June 20, 2024

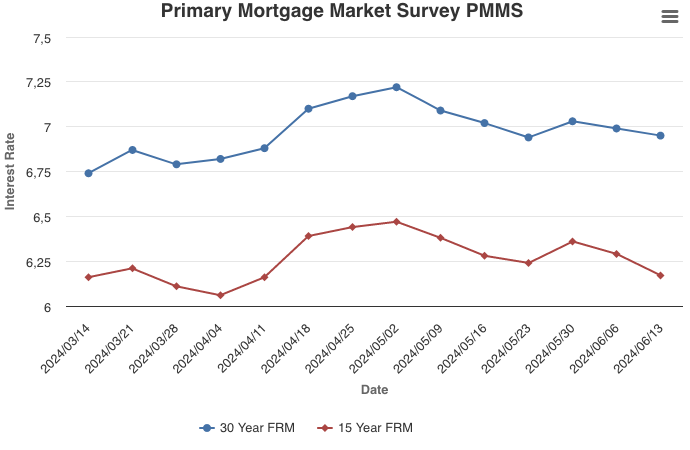

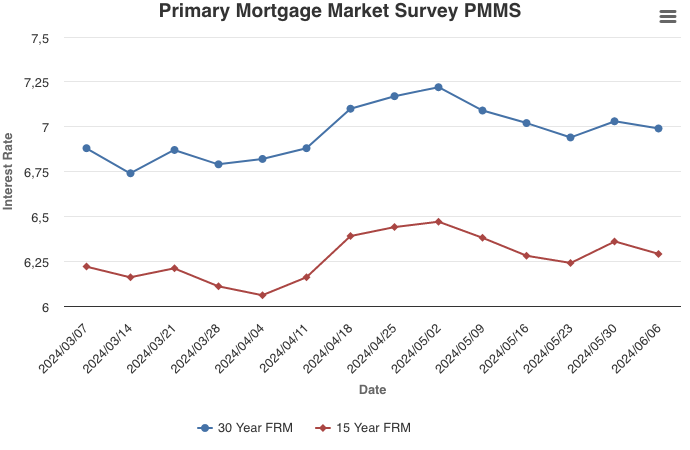

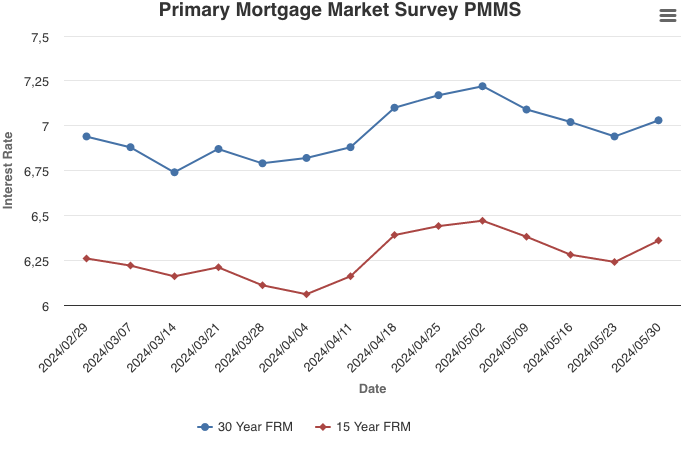

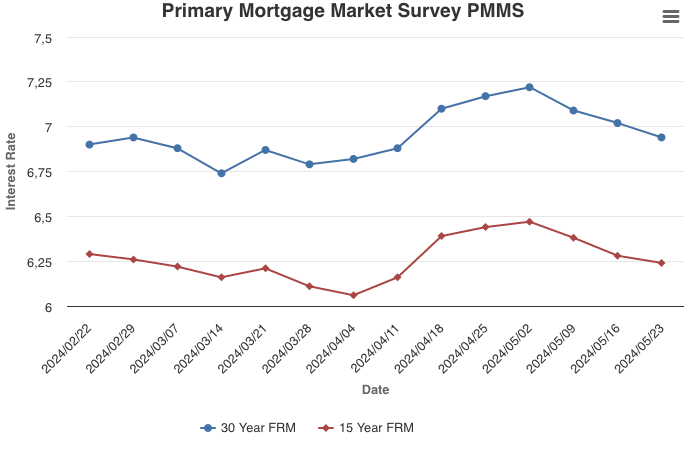

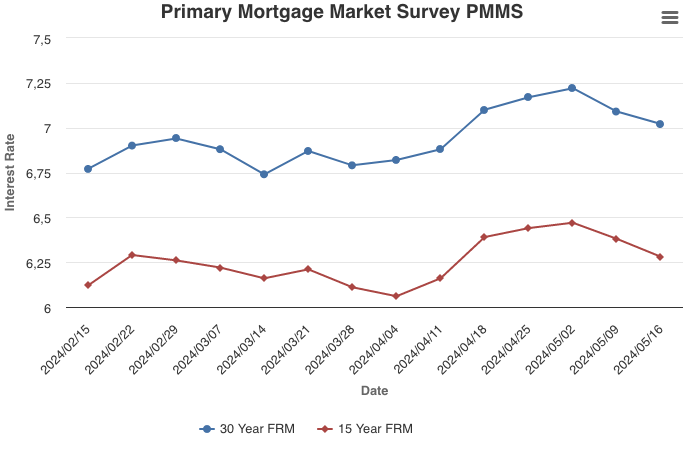

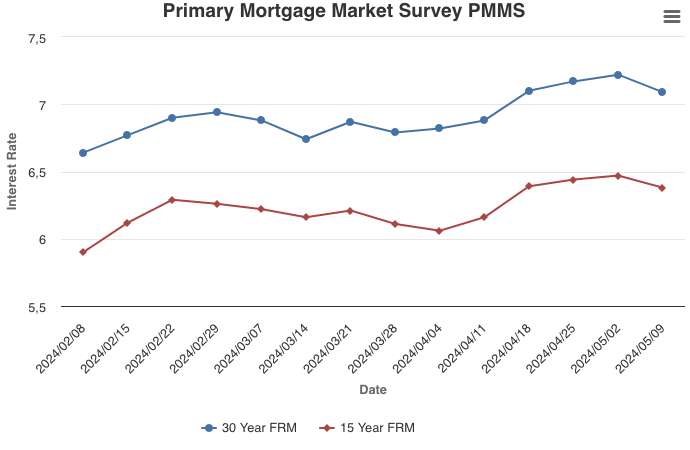

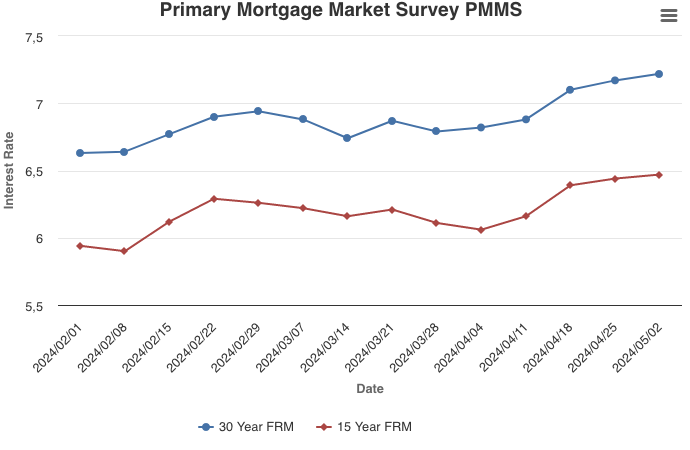

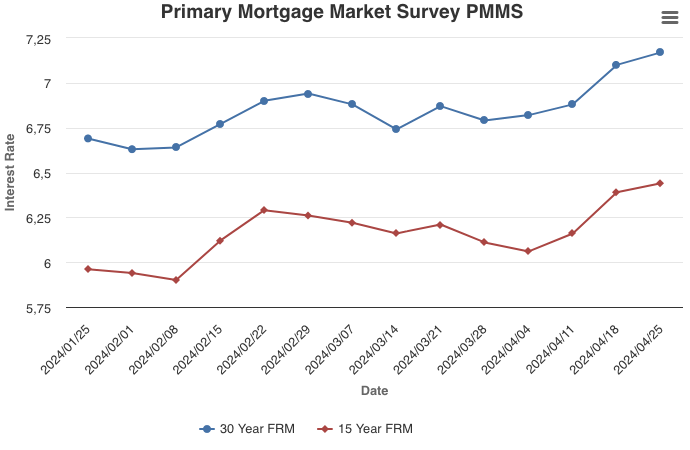

Mortgage rates fell for the third straight week following signs of cooling inflation and market expectations of a future Fed rate cut. These lower mortgage rates coupled with the gradually improving housing supply bodes well for the housing market. Aspiring homeowners should remember it’s important to shop around for the best mortgage rate as they can vary widely between lenders.

Information provided by Freddie Mac.