Weekly Market Report

For Week Ending August 3, 2024

For Week Ending August 3, 2024

The average rate on a 30-year mortgage fell to 6.73% the week ending August 1, 2024, the lowest level since early February, according to Freddie Mac. As a result, mortgage applications increased 6.9% on a seasonally adjusted basis from the previous week, boosted by a surge in refinance applications, which jumped 16%, while purchase applications rose 1%, per the Mortgage Bankers Association’s Weekly Applications Survey.

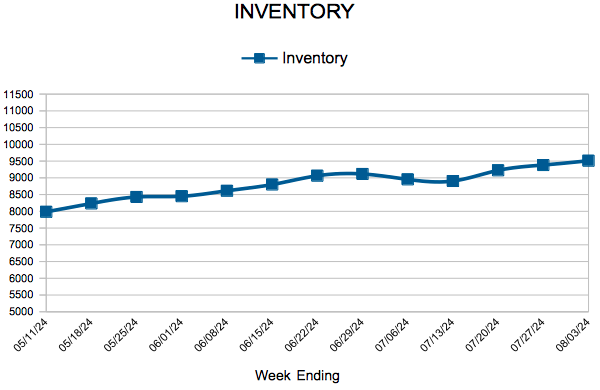

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING AUGUST 3:

- New Listings decreased 0.2% to 1,440

- Pending Sales decreased 0.4% to 1,052

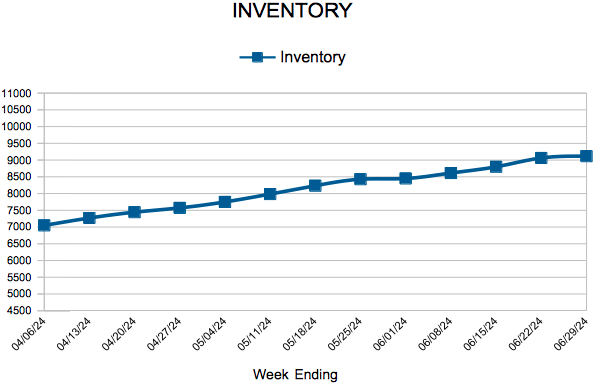

- Inventory increased 12.8% to 9,511

FOR THE MONTH OF JUNE:

- Median Sales Price increased 1.8% to $390,000

- Days on Market increased 12.9% to 35

- Percent of Original List Price Received decreased 1.2% to 100.1%

- Months Supply of Homes For Sale increased 19.0% to 2.5

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending July 27, 2024

For Week Ending July 27, 2024

According to ATTOM’s Q2 2024 U.S. Home Affordability Report, median priced single-family homes and condos were less affordable compared to historical averages in 99% of counties nationwide in the second quarter of the year. With sales prices on the rise, major homeownership expenses now require 35.1% of the average national wage, up from 31.9% in the first quarter, and the highest level since 2007.

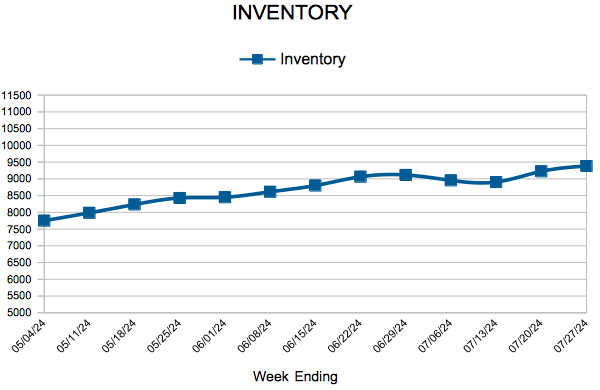

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 27:

- New Listings increased 7.0% to 1,475

- Pending Sales decreased 11.6% to 959

- Inventory increased 11.7% to 9,383

FOR THE MONTH OF JUNE:

- Median Sales Price increased 1.8% to $390,000

- Days on Market increased 12.9% to 35

- Percent of Original List Price Received decreased 1.2% to 100.1%

- Months Supply of Homes For Sale increased 19.0% to 2.5

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending July 13, 2024

For Week Ending July 13, 2024

U.S. homeowners with a mortgage saw their equity increase 9.6% year-over-year in the first quarter of 2024, an average gain of $28,000 and the highest number since 2022, according to CoreLogic’s Homeowner Equity Insights report. At the state level, California saw the greatest equity gain at an average of $64,000 annually, followed by Massachusetts and New Jersey, at $61,000 and $59,000, respectively.

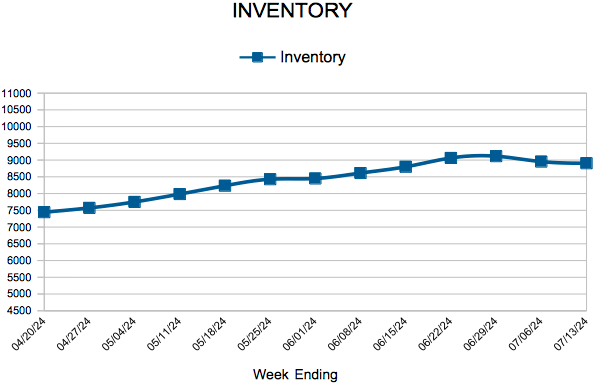

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 13:

- New Listings increased 4.8% to 1,640

- Pending Sales decreased 15.4% to 909

- Inventory increased 10.3% to 8,905

FOR THE MONTH OF JUNE:

- Median Sales Price increased 1.8% to $390,000

- Days on Market increased 9.7% to 34

- Percent of Original List Price Received decreased 1.2% to 100.1%

- Months Supply of Homes For Sale increased 14.3% to 2.4

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending July 6, 2024

For Week Ending July 6, 2024

U.S. housing starts fell 5.5% month-over-month to a seasonally adjusted annual rate of 1,277,000, according to the U.S. Census Bureau. Privately-owned housing completions also declined, dropping 8.4% from the previous month to a seasonally adjusted annual rate of 1,514,000, as higher interest rates and ongoing labor and supply challenges continue to impact new home construction.

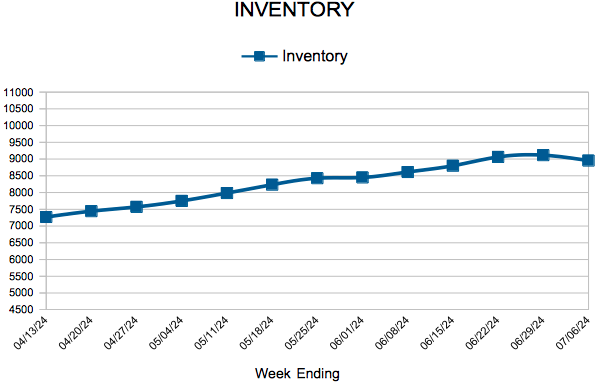

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 6:

- New Listings decreased 23.2% to 894

- Pending Sales decreased 1.4% to 823

- Inventory increased 12.4% to 8,954

FOR THE MONTH OF JUNE:

- Median Sales Price increased 1.8% to $390,000

- Days on Market increased 9.7% to 34

- Percent of Original List Price Received decreased 1.2% to 100.1%

- Months Supply of Homes For Sale increased 14.3% to 2.4

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending June 29, 2024

For Week Ending June 29, 2024

Nationally, the median down payment was $26,400, or 13.6% of the purchase price, in the first quarter of 2024, according to a recent study from Realtor.com, a slight decrease from the previous quarter, when the median down payment was $30,400 (14.7%). Down payments are up significantly from pre-pandemic levels: in the first quarter of 2020, the typical down payment was approximately $14,000, or 10.7% of the purchase price.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 29:

- New Listings increased 8.2% to 1,358

- Pending Sales decreased 12.0% to 1,061

- Inventory increased 12.2% to 9,116

FOR THE MONTH OF MAY:

- Median Sales Price increased 4.1% to $385,000

- Days on Market increased 7.9% to 41

- Percent of Original List Price Received decreased 1.1% to 100.0%

- Months Supply of Homes For Sale increased 26.3% to 2.4

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 43

- Next Page »