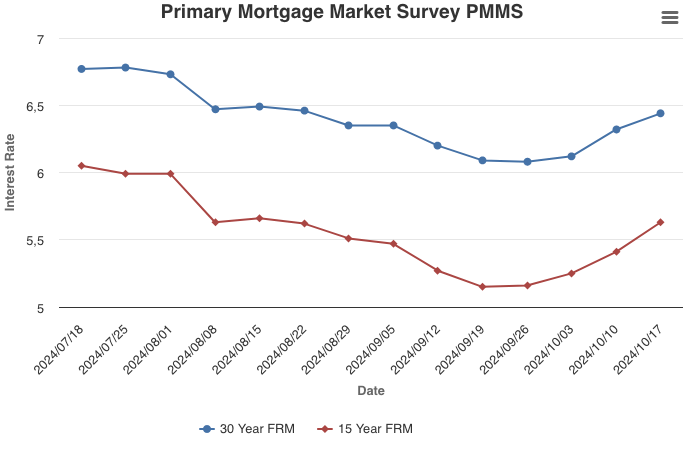

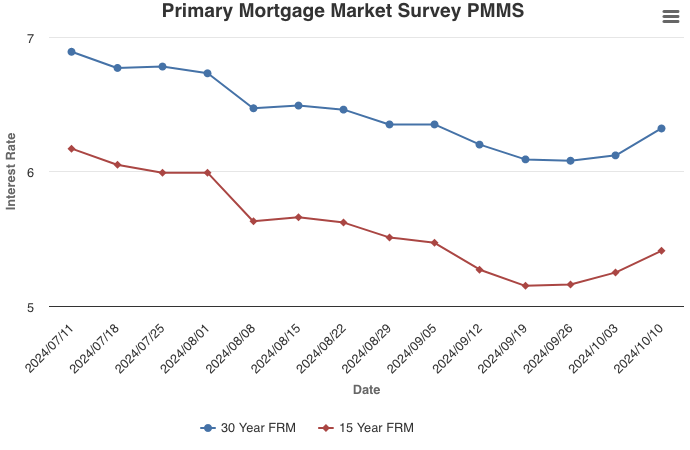

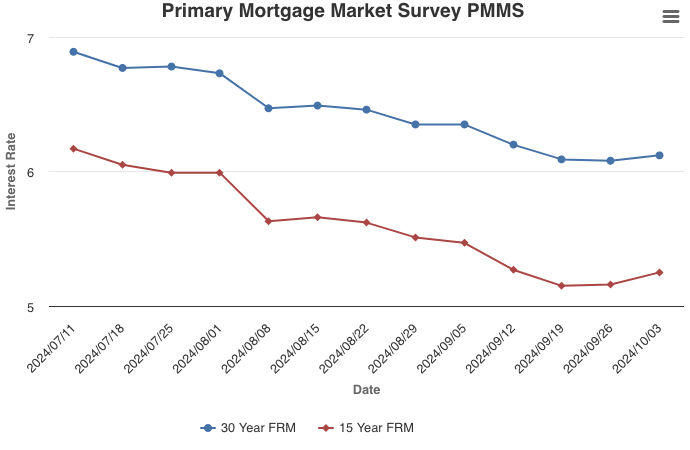

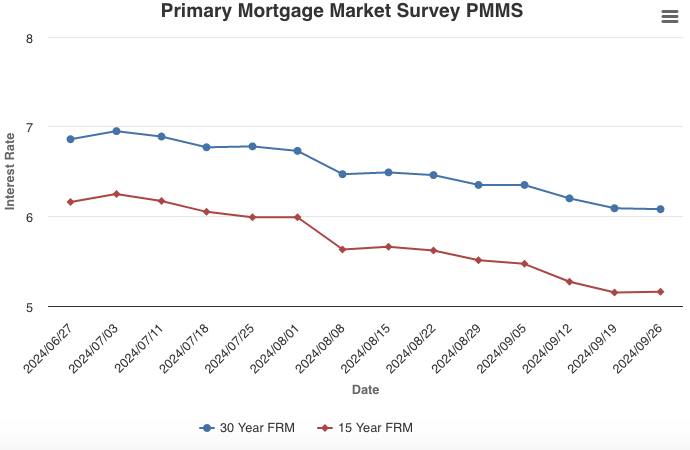

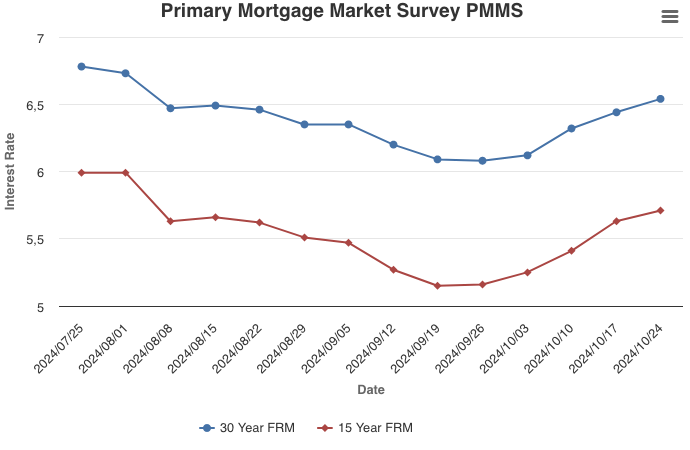

October 24, 2024

The continued strength in the economy drove mortgage rates higher once again this week. Over the last few years, there has been a tension between downbeat economic narrative and incoming economic data stronger than that narrative. This has led to higher-than-normal volatility in mortgage rates, despite a strengthening economy.

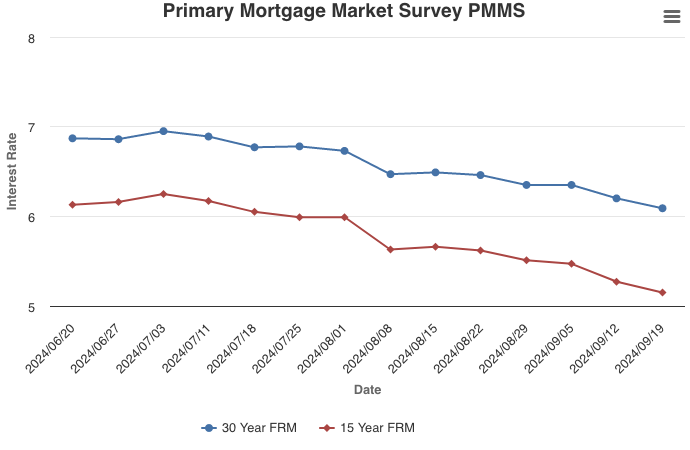

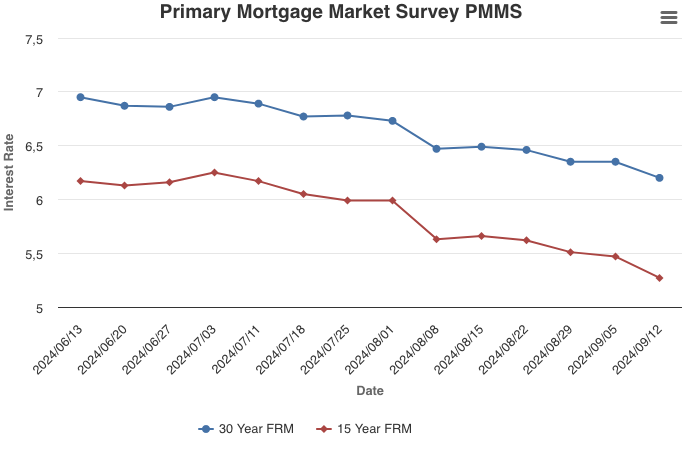

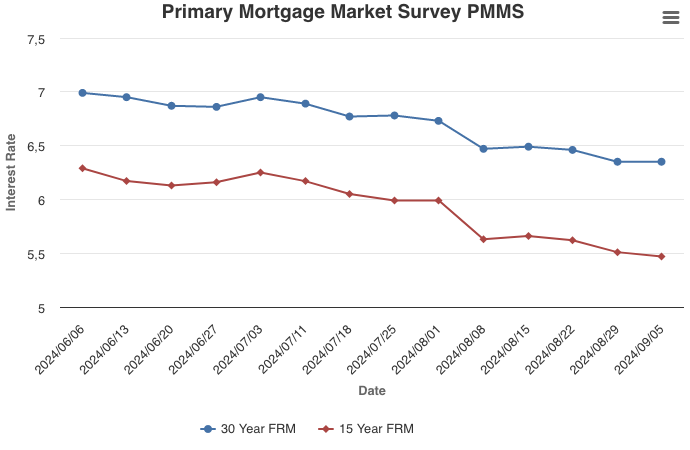

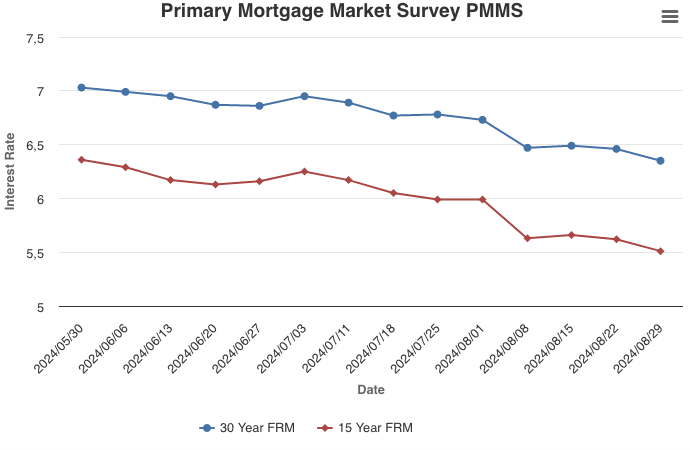

Information provided by Freddie Mac.