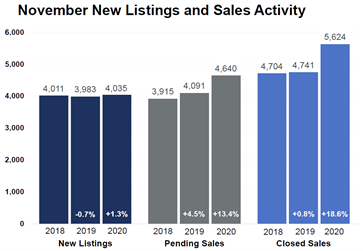

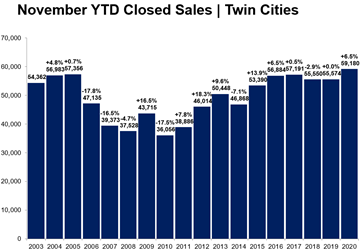

(December 17, 2020) – According to new data from the Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, the growth in buyer and seller activity in the 16-county Twin Cities metro continues to climb above 2019 levels. Seller activity rose 1.3 percent from last November while new purchase agreements were up 13.4 percent over last year. That marks the strongest November pending sales figure since 2004 and the highest closed sales since at least 2003.

This year, the fall and winter markets are behaving more like a spring market since activity was delayed from the spring and summer months. While sellers only listed slightly more units than last November, pending and closed sales were up significantly. Pending sales often act as a leading indicator of future demand while closings lag.“The Twin Cities housing market continues to exceed expectations,” according to Patrick Ruble, President of the Saint Paul Area Association of REALTORS®. “Despite record sales figures, the lack of adequate supply—particularly affordable units—continues to frustrate buyers.”

Historically low mortgage rates, shifting work and learning patterns, health concerns and other factors are driving this sellers’ market. While all areas and price points are unique, sellers are getting strong offers early on. On average, sellers obtained 100.2 percent of their original list price—the highest November figure since at least 2003. At a median of 15 days, homes went under contract in record time, and 48.3 percent faster than last November.

“It’s truly impressive that sales would reach new highs during a pandemic and an otherwise challenging year,” said Linda Rogers, President of Minneapolis Area REALTORS®. “That’s of course meant rising home prices, but luckily, ultra-low interest rates have been able to partly offset that.”

Sales were up 21.5 percent in Minneapolis and 30.8 percent in St. Paul, suggesting buyers are eager to quickly snap up any new listings. And the competitive landscape means those buyers are often going above list price. With prices slightly lower, market times higher and offers weaker, the condo market continues to lag other segments. However, sales of luxury properties ($1M+) have been soaring higher—up nearly 20.0 percent YTD. One thing is clear: the housing market continues to outperform, despite the many economic headwinds.

November 2020 by the numbers compared to a year ago

- Sellers listed 4,035 properties on the market, a 1.3 percent increase from last November

- Buyers signed 4,640 purchase agreements, up 13.4 percent (5,624 closed sales, up 18.6 percent)

- Inventory levels fell 37.9 percent to 6,642 units

- Months Supply of Inventory was down 42.9 percent to2 months (5-6 months is balanced)

- The Median Sales Price rose 10.7 percent to $310,000

- Days on Market decreased 33.3 percent to 34 days, on average (median of 15, down 48.3 percent)

- Changes in Sales activity varied by market segment

- Single family sales were up 21.3 percent; condo sales fell 2.6 percent; townhome sales increased 20.6 percent

- Traditional sales rose 19.7 percent; foreclosure sales were down 22.9 percent; short sales fell 18.8 percent

- Previously owned sales were up 21.7 percent; new construction sales climbed 4.8 percent