December 12, 2024

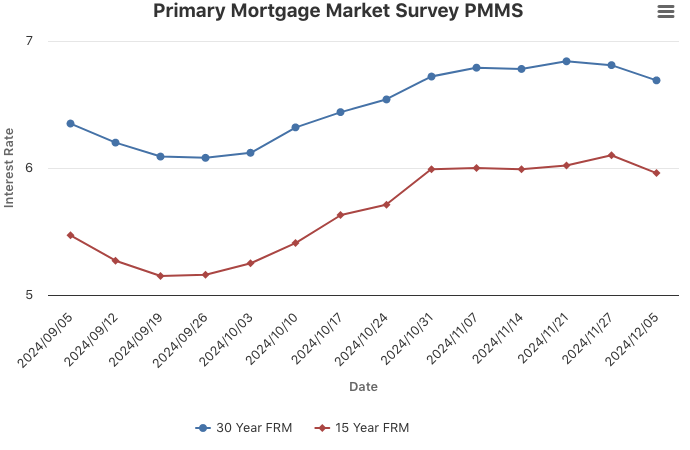

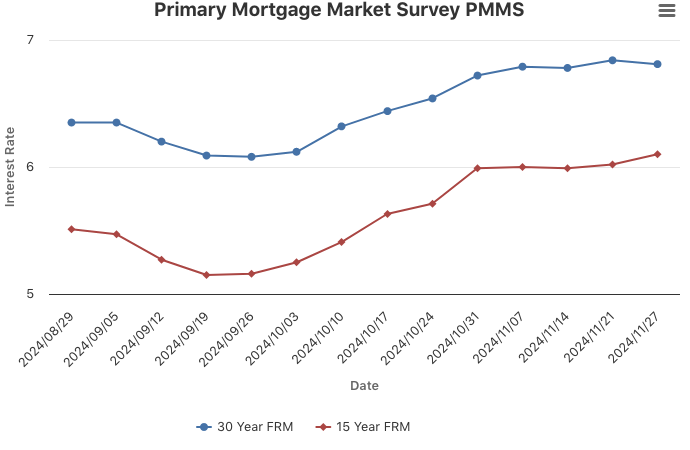

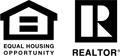

The 30-year fixed-rate mortgage decreased for the third consecutive week. The combination of mortgage rate declines, firm consumer income growth and a bullish stock market have increased homebuyer demand in recent weeks. While the outlook for the housing market is improving, the improvement is limited given that homebuyers continue to face stiff affordability headwinds.

Information provided by Freddie Mac.

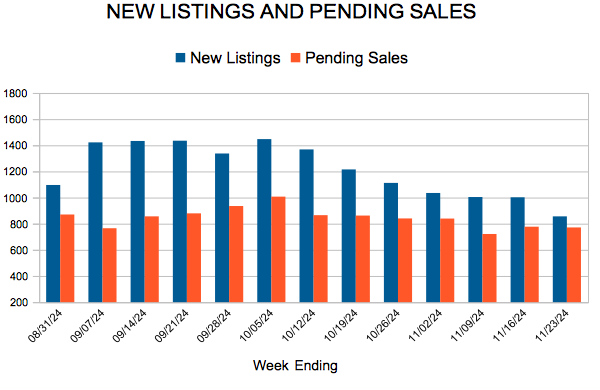

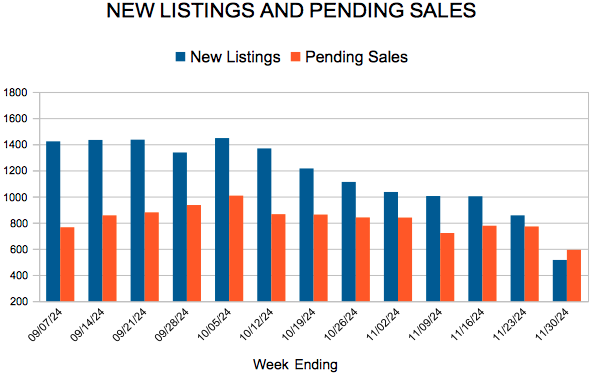

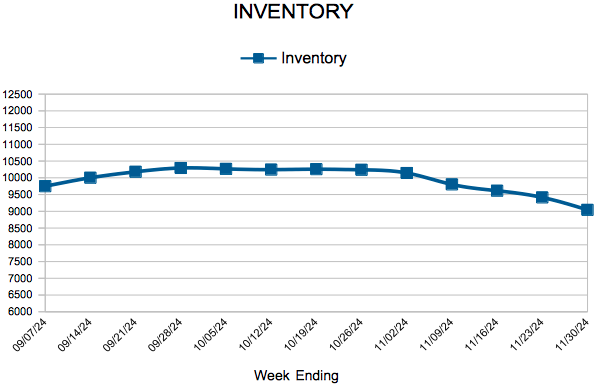

For Week Ending November 30, 2024

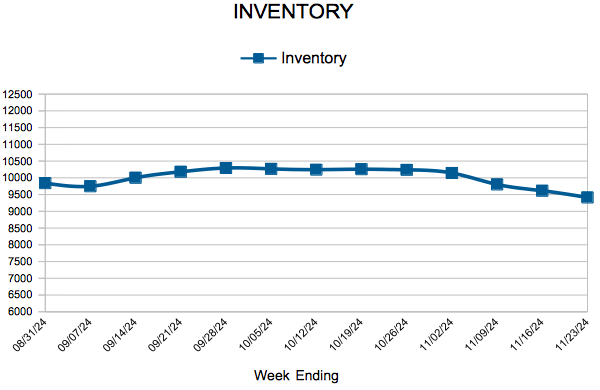

For Week Ending November 30, 2024