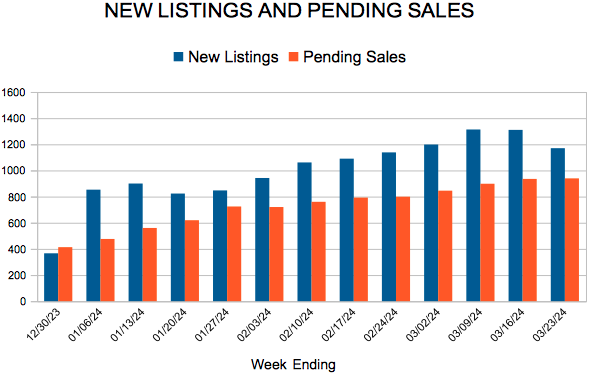

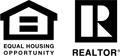

- Signed purchase agreements rose 7.8%; new listings up 4.0%

- The median sales price increased 2.8% to $366,000

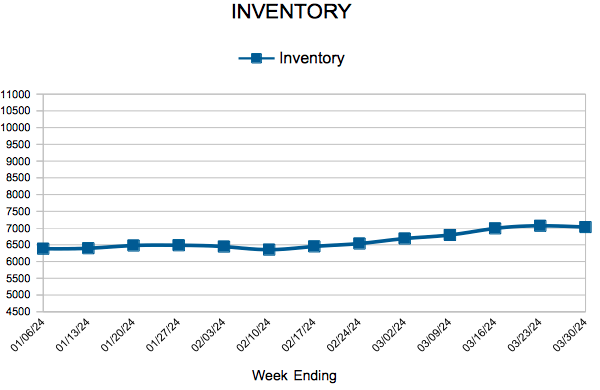

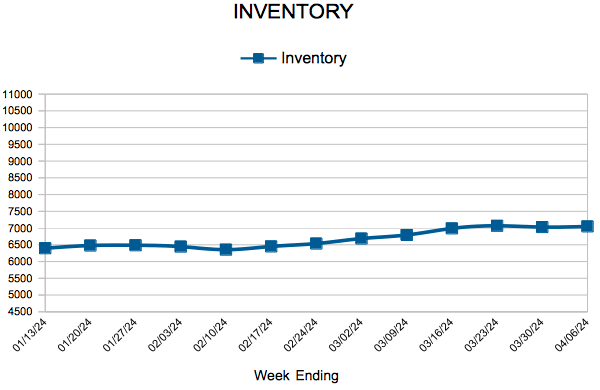

- Market times fell 6.9% to 54 days; inventory up 8.4% to 6,879

(Apr. 15, 2024) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, both buyer and seller activity rose in March. Inventory levels and prices were also higher.

Sellers, Buyers and Housing Supply

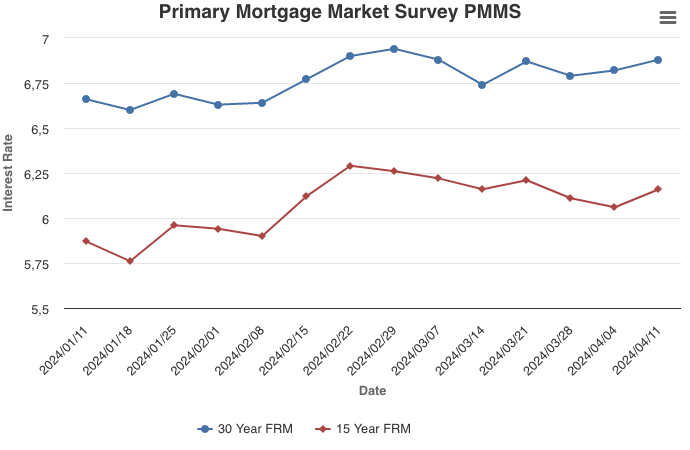

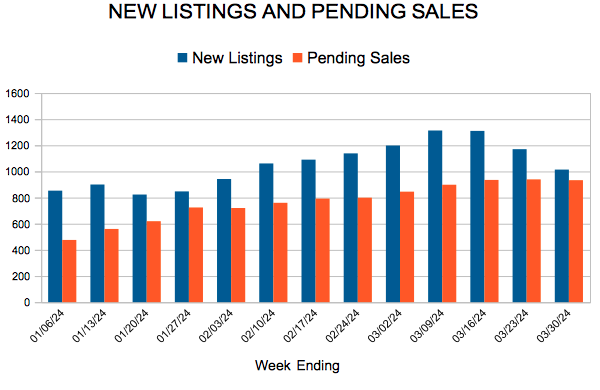

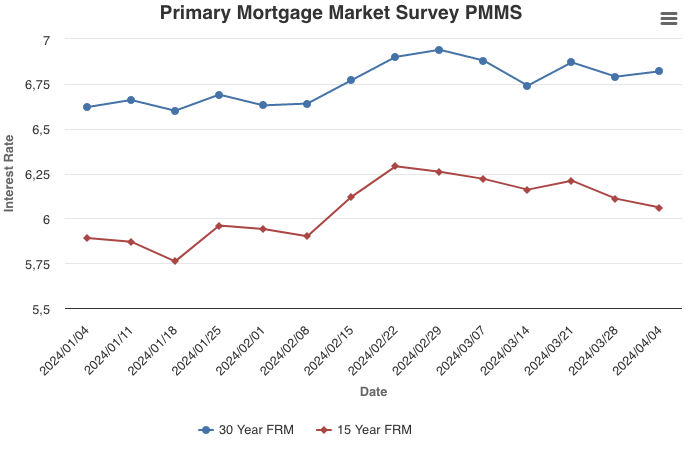

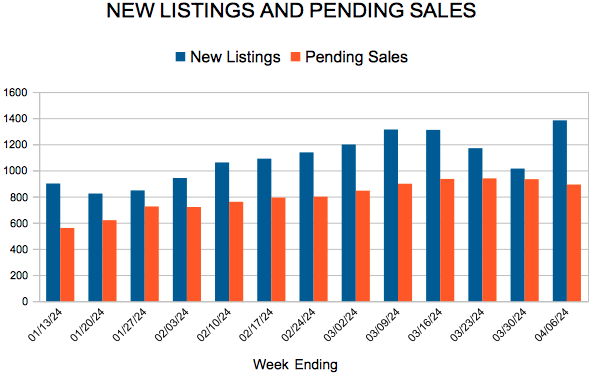

With warmer temperatures comes heightened home buyer and seller activity. Metro-wide, we’ve now seen five consecutive year-over-year increases in new listings and four consecutive increases in pending sales. During the first quarter (YTD), seller activity rose 17.9% while pending sales were up 9.4%. That’s allowed inventory levels to also rise—most recently up 8.4% to 6,879 active listings. While buyers can expect to see more listings in their searches, most areas and sub-markets still favor sellers. There is a good amount of pent-up activity from buyers and sellers that’s been accumulating from when rates jumped. The backlog is starting to be released as more consider making a move. In some ways, residents of the Twin Cities are adjusting to the higher rate environment, but low supply and rising prices combined with higher rates have held back too many from homeownership—particularly first-time buyers without the equity from their first home. Move-up buyers and those looking at pricier segments are less rate-sensitive and so activity is rising more quickly higher up on the price spectrum.

Prices, Market Times and Negotiations

Perhaps surprisingly, REALTORS® still report multiple offer situations in some markets and price points. If rates were to ease further toward 6.0%, that will continue. Listings spent 6.9% fewer days on market compared to last March. And sellers accepted offers at 98.8% of their asking price, up 0.2% from last year. “It’s clear that people are ready and eager to get deals done,” said Jamar Hardy, President of Minneapolis Area REALTORS®. “But even a few months of increases in available listings doesn’t mean the housing shortage is behind us. We’re still having to be persistent, strategic and creative when it comes to getting people into homes.”

Supply levels are too low for prices to fall but rates are too high for prices to rise much. The median home price in March was up 2.8% to $366,000 which amounts to $208 per finished square foot. During the month, sellers accepted offers on their listings after an average of 54 days (median of 24) compared to 58 days last March. Sellers are still in a relatively strong position, but some are having to make concessions by way of a price reduction, seller paid closing costs and other incentives.

“We’re in a unique place. The market remains tight even as we see it loosening a bit with more inventory and more buyers coming out to shop,” said Amy Peterson, President of the Saint Paul Area Association of REALTORS®. “A market like this is never monolithic. Every price point, segment and area are different—sometimes very different. That’s why it’s important to partner with an experienced real estate professional.”

Location & Property Type

Market activity always varies by area, price point and property type. Existing home sales rose faster than new home sales. Single family sales rose while condo and townhome sales declined. Sales over $500,000 rose at over five times the rate of sales under $500,000. Cities such as Robbinsdale, Columbia Heights and Corcoran saw among the largest sales gains while Forest Lake, Victoria and Delano all had notably weaker demand. For cities with at least five sales, the highest priced areas were Medina, Lake Elmo and Orono while the most affordable areas were Red Wing, Mora, Columbia Heights and Faribault.

March 2024 Housing Takeaways (compared to a year ago)

- Sellers listed 5,261 properties on the market, a 4.0% increase from last March

- Buyers signed 4,028 purchase agreements, up 7.8% (3,238 closed sales, down 0.9%)

- Inventory levels rose 8.4% to 6,879 units

- Month’s Supply of Inventory rose 20.0% to 1.8 months (4-6 months is balanced)

- The Median Sales Price was up 2.8% to $366,000

- Days on Market was down 6.9% to 54 days, on average (median of 24 days, down 11.1%)

- Changes in Pending Sales activity varied by market segment and price point

- Single family sales rose 12.8%; condo sales were down 15.6%; townhouse sales decreased 1.2%

- Traditional sales were up 8.0%; foreclosure sales fell 11.9% to 37; short sales rose 11.1% to 10

- Previously owned sales increased 8.9%; new construction sales were up 2.3%

- Sales under $500,000 rose 3.9%; sales over $500,000 increased 20.3%

For Week Ending April 6, 2024

For Week Ending April 6, 2024