For Week Ending February 10, 2024

For Week Ending February 10, 2024

Seller profits declined for the first time since 2011, according to ATTOM’s Year-End 2023 U.S. Home Sales Report, which found that home sellers made a $121,000 profit on the sale of a median-priced single-family home in 2023, resulting in a 56.5% return on investment year-over-year. This is a slight drop from 2022, when home sellers made $122,600 on the sale of a typical single-family home, for a 59.8% return on investment. Despite the decline, however, seller profits and profit margins remained near record levels last year.

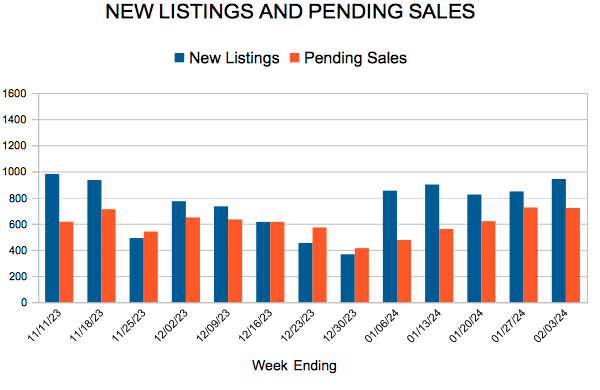

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING FEBRUARY 10:

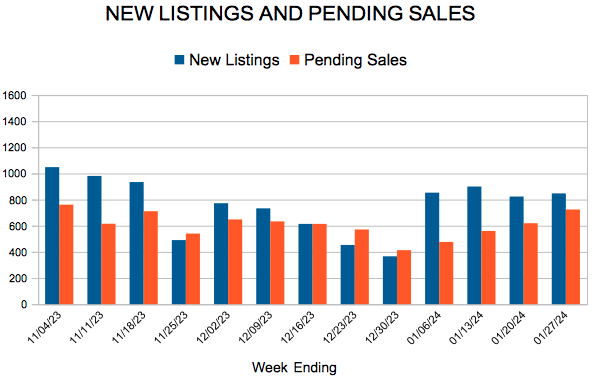

- New Listings increased 18.4% to 1,061

- Pending Sales increased 6.1% to 760

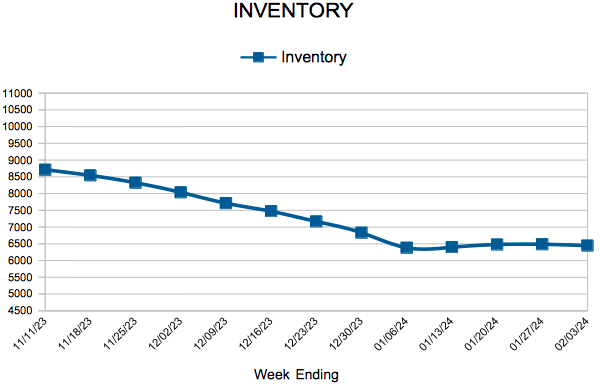

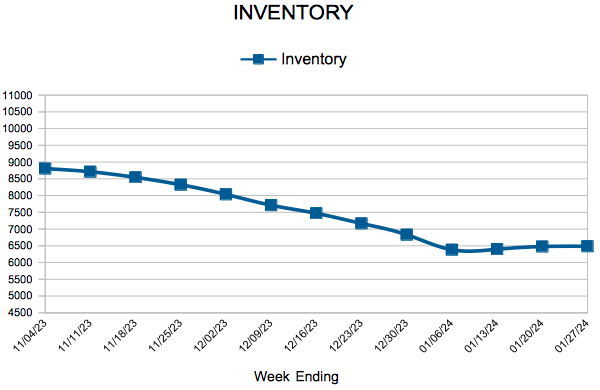

- Inventory increased 3.5% to 6,355

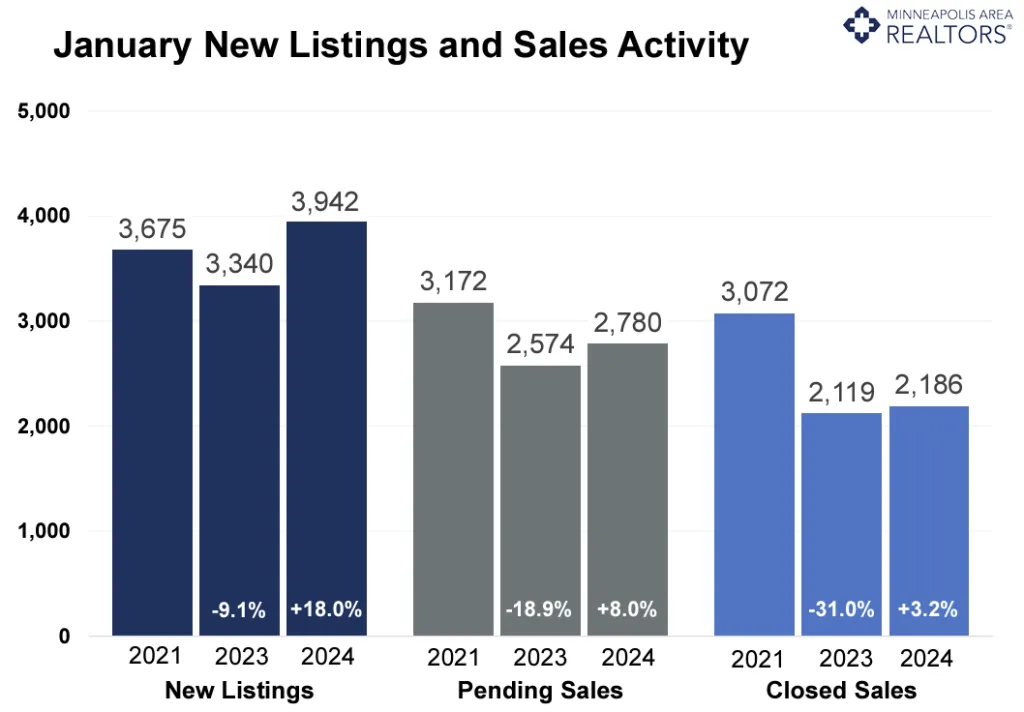

FOR THE MONTH OF JANUARY:

- Median Sales Price increased 3.2% to $353,035

- Days on Market decreased 8.2% to 56

- Percent of Original List Price Received increased 0.7% to 96.7%

- Months Supply of Homes For Sale increased 21.4% to 1.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.