Weekly Market Report

For Week Ending July 29, 2023

For Week Ending July 29, 2023

Single-family housing starts fell 8% to a seasonally adjusted annual rate of 1.43 million in June, according to a joint report from the U.S. Census Bureau and the Department of Housing and Urban Development, as higher interest rates and supply chain challenges continue to impact homebuilders and slow construction activity. Despite the decline, however, single-family permits were up 2.2% month-over-month, the highest pace since June 2022, according to the report.

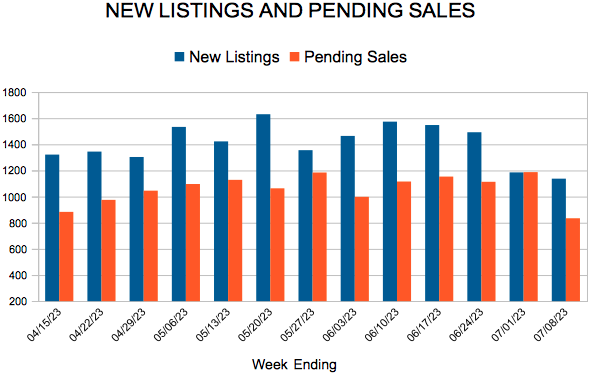

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 29:

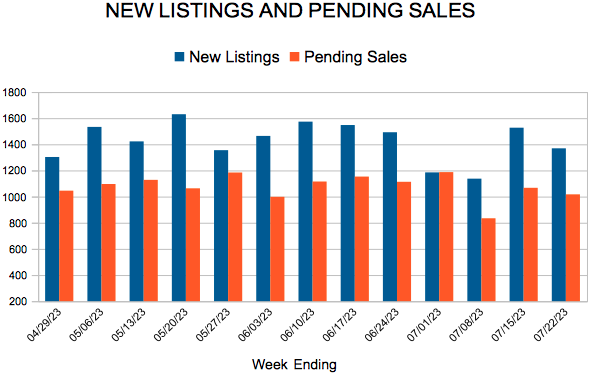

- New Listings decreased 9.3% to 1,340

- Pending Sales decreased 8.7% to 1,077

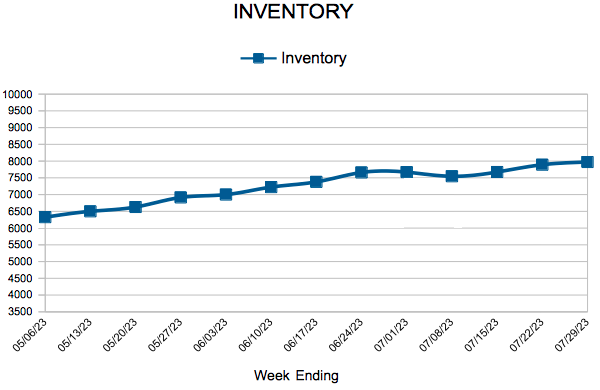

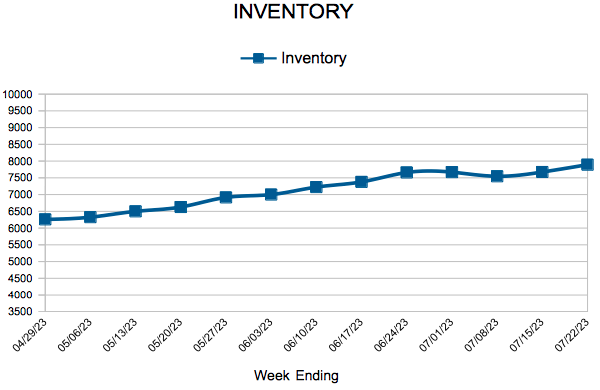

- Inventory decreased 14.4% to 7,972

FOR THE MONTH OF JUNE:

- Median Sales Price increased 0.5% to $382,000

- Days on Market increased 47.6% to 31

- Percent of Original List Price Received decreased 1.9% to 101.3%

- Months Supply of Homes For Sale increased 17.6% to 2.0

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

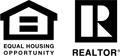

Mortgage Rates Increase

August 3, 2023

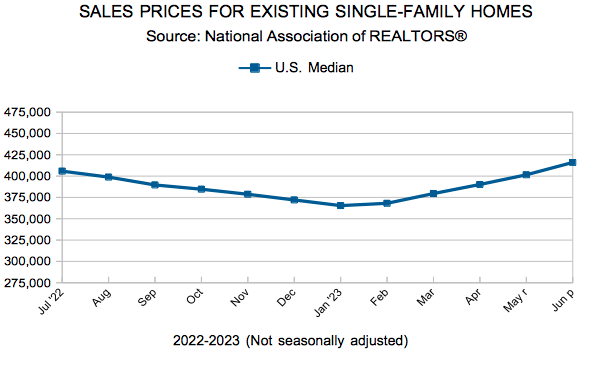

The combination of upbeat economic data and the U.S. government credit rating downgrade caused mortgage rates to rise this week. Despite higher rates and lower purchase demand, home prices have increased due to very low unsold inventory.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending July 22, 2023

For Week Ending July 22, 2023

Home prices hit a new high in May, rising a seasonally adjusted 0.7% month-overmonth, according to the latest Black Knight Home Price Index (HPI), marking the fifth consecutive monthly price increase. The report found that 27 of the 50 largest markets have seen prices return to or exceed their 2022 peaks, with many of those markets located in the Midwest and Northeast, although price gains remain weaker in the West and in areas that saw significant price gains during the pandemic.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JULY 22:

- New Listings decreased 17.1% to 1,369

- Pending Sales decreased 13.2% to 1,017

- Inventory decreased 14.4% to 7,892

FOR THE MONTH OF JUNE:

- Median Sales Price increased 0.5% to $382,000

- Days on Market increased 47.6% to 31

- Percent of Original List Price Received decreased 1.9% to 101.3%

- Months Supply of Homes For Sale increased 17.6% to 2.0

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

June Monthly Skinny Video

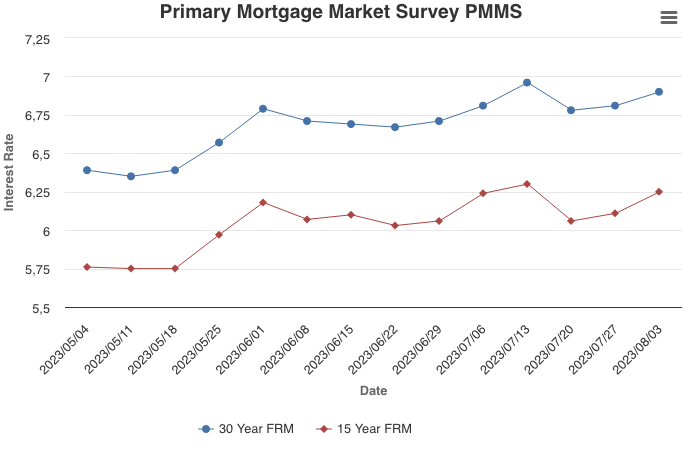

Mortgage Rates Dip

July 20, 2023

As inflation slows, mortgage rates decreased this week. Still, the ongoing shortage of previously owned homes for sale has been a detriment to homebuyers looking to take advantage of declining rates. On the other hand, homebuilders have an edge in today’s market, and incoming data shows that homebuilder sentiment continues to rise.

Information provided by Freddie Mac.

Existing Home Sales

New Listings and Pending Sales

- « Previous Page

- 1

- …

- 41

- 42

- 43

- 44

- 45

- …

- 103

- Next Page »