For Week Ending June 24, 2023

For Week Ending June 24, 2023

According to the latest data from the Census Bureau, the U.S. median square footage of single-family homes under construction rose slightly to 2,261 square feet in Q1 2023, up from 2,207 square feet in Q4 2022, but down from 2,310 square feet in Q1 2022. New home sizes decreased steadily last year, reversing the trend seen in 2021, when home sizes increased due to historically low interest rates and buyers spending more time at home during the pandemic.

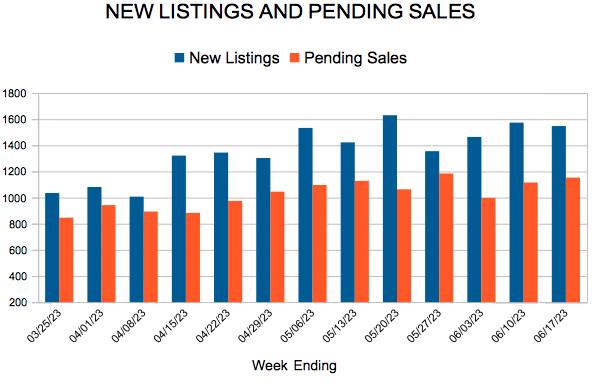

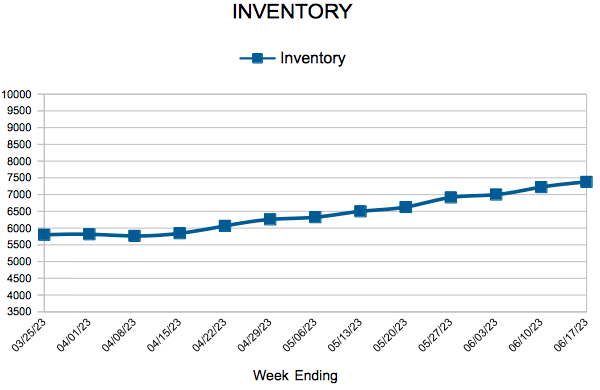

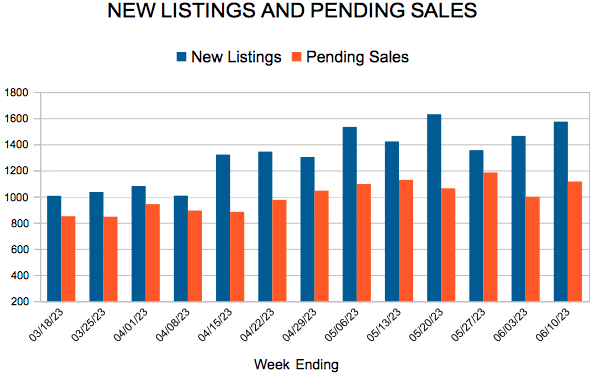

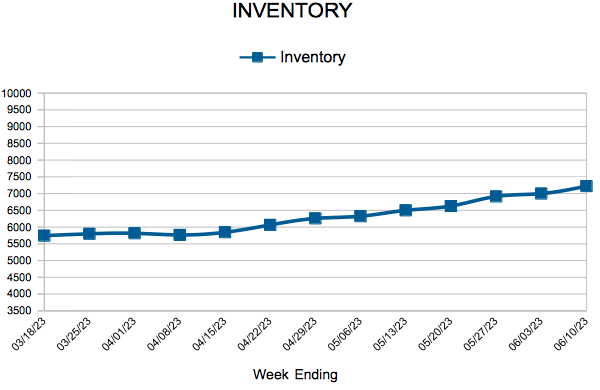

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JUNE 24:

- New Listings decreased 20.9% to 1,492

- Pending Sales decreased 11.3% to 1,113

- Inventory decreased 9.7% to 7,660

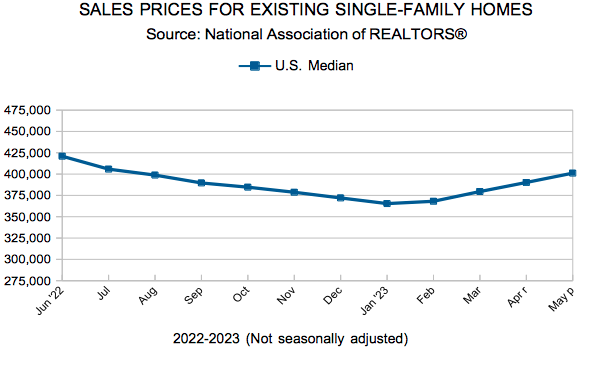

FOR THE MONTH OF MAY:

- Median Sales Price decreased 1.3% to $370,000

- Days on Market increased 65.2% to 38

- Percent of Original List Price Received decreased 2.9% to 101.1%

- Months Supply of Homes For Sale increased 35.7% to 1.9

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.