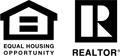

January 19, 2023

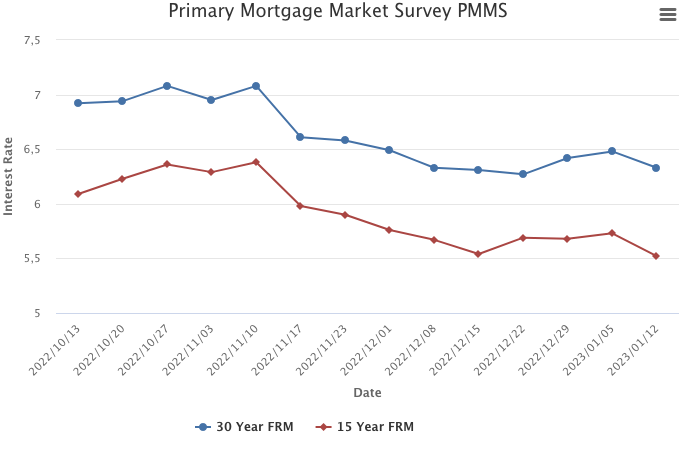

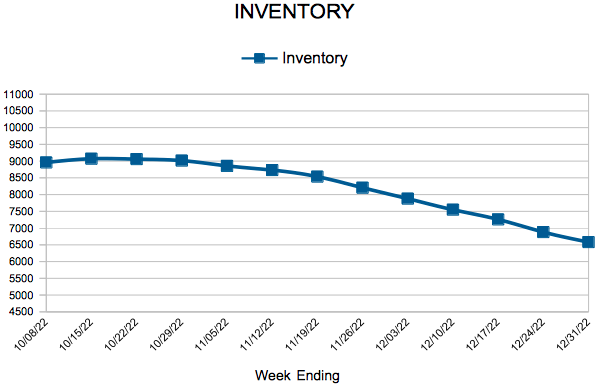

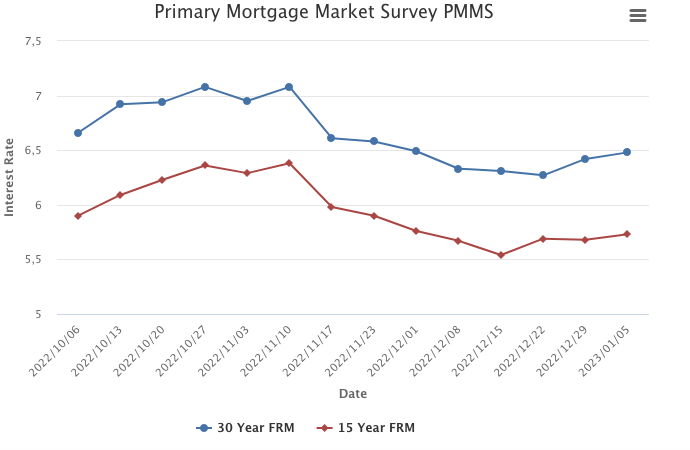

As inflation continues to moderate, mortgage rates declined again this week. Rates are at their lowest level since September of last year, boosting both homebuyer demand and homebuilder sentiment. Declining rates are providing a much-needed boost to the housing market, but the supply of homes remains a persistent concern.

Information provided by Freddie Mac.

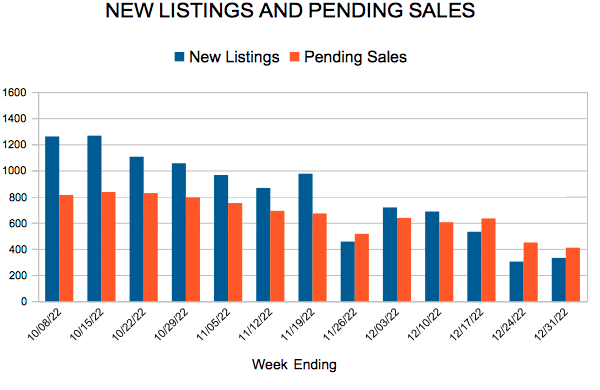

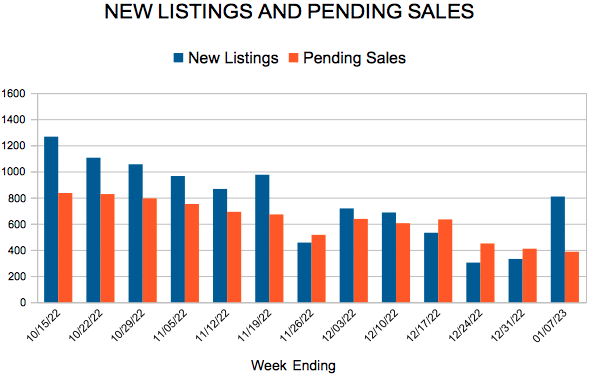

For Week Ending January 7, 2023

For Week Ending January 7, 2023