Inventory

Weekly Market Report

For Week Ending May 14, 2022

For Week Ending May 14, 2022

With home prices and mortgage rates continuing to rise, down payments are increasing nationwide, as buyers aim to lower their monthly mortgage costs and make their offer more attractive to sellers. According to Realtor.com, buyers averaged a $28,000 down payment in the first quarter of 2022, averaging 13.1% of the purchase price, compared to the first quarter of 2020, when down payments averaged $14,000, with buyers paying about 11% of the purchase price.

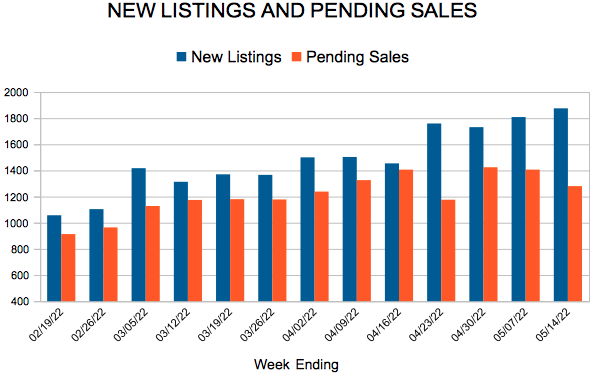

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 14:

- New Listings decreased 6.2% to 1,875

- Pending Sales decreased 19.3% to 1,280

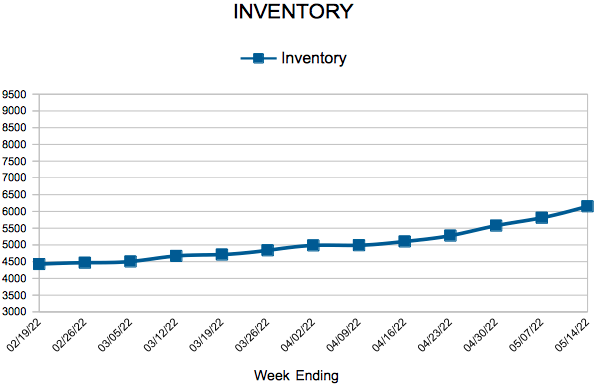

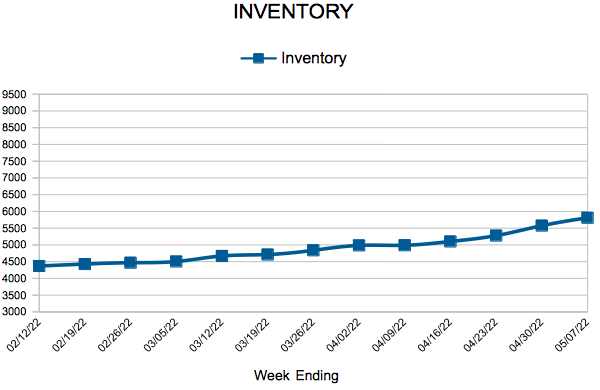

- Inventory decreased 2.9% to 6,152

FOR THE MONTH OF APRIL:

- Median Sales Price increased 10.0% to $370,000

- Days on Market decreased 9.7% to 28

- Percent of Original List Price Received increased 0.5% to 103.8%

- Months Supply of Homes For Sale remained flat at 1.1

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

April Monthly Skinny Video

Mortgage Rates Decrease Slightly

May 19, 2022

Economic uncertainty is causing mortgage rate volatility. As a result, purchase demand is waning, and homebuilder sentiment has dropped to the lowest level in nearly two years. Builders are also dealing with rising costs, meaning this posture is likely to continue.

Information provided by Freddie Mac.

Existing Home Sales

Home prices hit $370,000 as rates push affordability to lowest level since 2004

- Both pending and closed home sales were down about 9.0 percent from last April

- Inventory was down 9.2 percent to 5,758 units, the twenty-fifth consecutive month of declines

- Median Sales Price reached a record $370,000, up 10.0 percent from last year

(May 16, 2022) – According to new data from Minneapolis Area REALTORS® and the Saint Paul Area Association of REALTORS®, the Twin Cities metro area saw rising prices, fast market times and strong offers—often over asking price—during April. But rising mortgage rates have forced the affordability index below 100 for the first time since at least 2004.

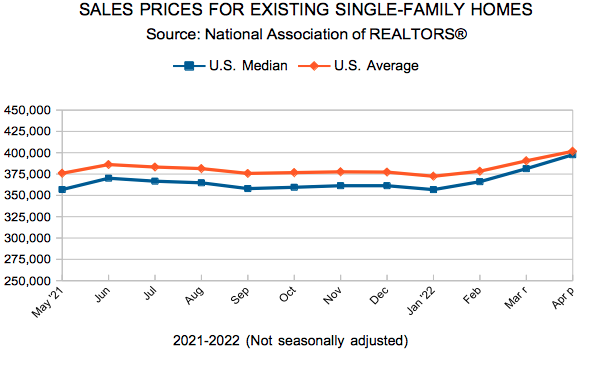

HOME PRICES & INVENTORY

While the median home price rose 10.0 percent to reach a new record of $370,000—and will likely do so again over the next couple months—declines in affordability have continued to weigh on some buyers who are already fatigued from writing several offers. Historically low interest rates have been offsetting the effect of rising prices on monthly mortgage payments. But that’s quickly changing as the Federal Reserve races to combat high inflation by raising rates. Even so, the long-term average 30-year fixed mortgage rate is about 8.0 percent, above where we currently stand at around 5.2 percent. The affordability index fell to 95, meaning the median income was 95.0 percent of the necessary income needed to qualify for the median priced home under prevailing interest rates.

Despite affordability concerns, the supply-demand imbalance will likely keep prices firm. Some buyers may need to re-evaluate their target price to keep monthly payments at a level they’re comfortable with. We ended April with 5,758 homes on the market, 9.2 percent fewer than April 2021 and the twenty-fifth straight month of year-over-year inventory declines. This amounts to just 1.1 months’ supply of inventory, giving sellers the upper hand (a balanced market has four to six months’ supply). “Even with several justifiable concerns, this market continues to outperform,” according to Mark Mason, President of the Saint Paul Area Association of REALTORS®.

LISTINGS & SALES

Due to several factors, buyer activity has moderated somewhat. First, we’re comparing against the highs of the Covid housing craze from last spring. Second, inventory is even lower and further pressuring sales. Third, rising rates have likely taken some buyers out of the market. Buyers signed 9.2 percent fewer purchase agreements than April of last year and closed on 9.0 percent fewer homes. Sellers listed 7.0 percent fewer homes than last April. Sellers may feel attached to their interest rate and reluctant to list their homes to avoid higher interest rates.

While still high, it’s possible inflation has peaked. Financial experts report that annual inflation moderated for the first time in months. “It’s the rates and payment piece that is of concern to many of the buyers I work with,” said Denise Mazone, President of Minneapolis Area REALTORS®. “The reality is that people will need to buy and sell homes in any environment, but this really puts pressure on those who are on a budget.” Listings spent 9.7 percent fewer days on market than April 2021 on average. But the median days on market showed half of all homes went under contract in under 8 days, which is even with last April’s pace. This could be a sign of stabilization, yet sellers accepted offers 3.8 percent higher than their list price, on average.

LOCATION & PROPERTY TYPE

Market activity varies by area, price point and property type. New and existing home sales fell 3.5 and 8.0 percent, respectively. Single family sales fell 8.3 percent while condo sales rose 1.5 percent. Sales in Minneapolis declined 3.2 percent while Saint Paul sales fell 17.7 percent. The Longfellow, University, Summit Hill and West Seventh neighborhoods saw the largest sales gains while Hopkins, Mounds View, Wyoming and Somerset also had significant demand increases.

APRIL 2022 BY THE NUMBERS (COMPARED TO A YEAR AGO)

- Sellers listed 7,046 properties on the market, a 7.0 percent decrease from last April

- Buyers signed 5,693 purchase agreements, down 9.2 percent (4,706 closed sales, down 9.0 percent)

- Inventory levels fell 9.2 percent to 5,758 units

- Month’s Supply of Inventory remained level at 1.1 month (4-6 months is balanced)

- The Median Sales Price rose 10.0 percent to $370,000

- Days on Market fell 9.7 percent to 28 days, on average (median of 8 days, same as April 2021)

- Changes in Sales activity varied by market segment

- Single family sales decreased 8.3 percent; Condo sales rose 1.5 percent & townhouse sales declined 10.9 percent

- Traditional sales were down 7.8 percent; foreclosure sales fell 24.2 percent; short sales were up 25.0 percent (from 4 to 5)

- Previously owned sales declined 8.0 percent; new construction sales fell 3.5 percent

April 2022 HOUSING CHARTS

From The Skinny Blog.

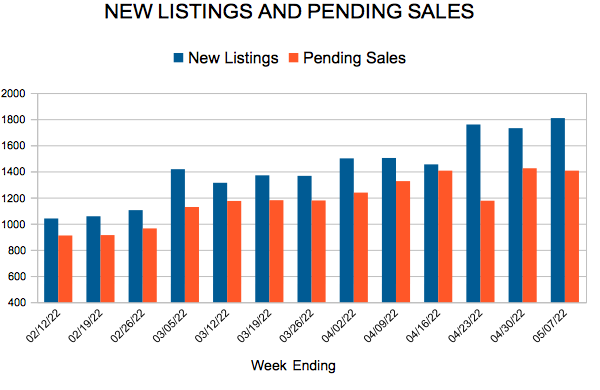

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending May 7, 2022

For Week Ending May 7, 2022

Demand for adjustable-rate mortgages (ARMs) is rising, as buyers look to mitigate higher monthly payments caused by record-high sales prices and surging mortgage interest rates. Although less popular than fixed rate mortgages, ARMs offer introductory rates lower than rates from conventional mortgages and currently represent 11% of mortgage loans, up from 3% at the beginning of the year, according to the Mortgage Bankers Association.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING MAY 7:

- New Listings decreased 5.7% to 1,808

- Pending Sales decreased 11.6% to 1,406

- Inventory decreased 5.2% to 5,811

FOR THE MONTH OF APRIL:

- Median Sales Price increased 10.0% to $370,000

- Days on Market decreased 9.7% to 28

- Percent of Original List Price Received increased 0.5% to 103.8%

- Months Supply of Homes For Sale remained flat at 1.1

All comparisons are to 2021

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 68

- 69

- 70

- 71

- 72

- …

- 103

- Next Page »