Weekly Market Report

For Week Ending July 31, 2021

For Week Ending July 31, 2021

The percentage of first-time home buyers fell to 31% in June, the lowest level in more than 3 decades, according to the National Association of REALTORS®. Cash offers, bidding wars, and soaring home prices are making it increasingly difficult for first-time buyers to compete in a market with record low inventory and declining housing affordability, even as 30-year mortgage rates dropped below 3 percent for the first time since February.

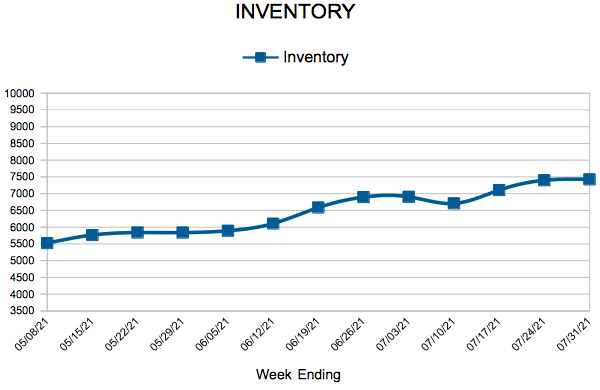

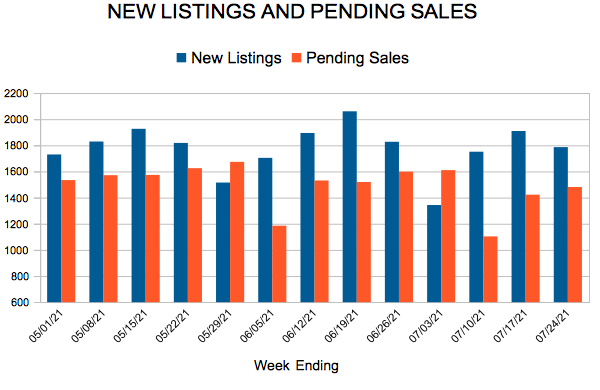

In the Twin Cities region, for the week ending July 31:

- New Listings decreased 1.6% to 1,832

- Pending Sales decreased 10.4% to 1,476

- Inventory decreased 25.9% to 7,427

For the month of June:

- Median Sales Price increased 14.8% to $350,000

- Days on Market decreased 52.4% to 20

- Percent of Original List Price Received increased 4.5% to 104.1%

- Months Supply of Homes For Sale decreased 42.9% to 1.2

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

New Listings and Pending Sales

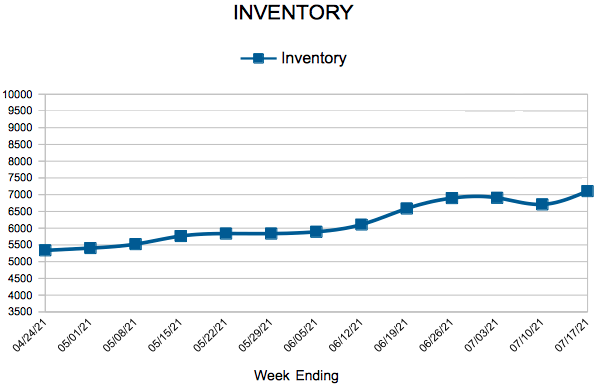

Inventory

Weekly Market Report

For Week Ending July 24, 2021

For Week Ending July 24, 2021

Sales of new construction single-family homes fell to a 14-month low, dropping 6.6% in June compared to May, according to the Commerce Department, although sales of new homes remain 13.5% higher compared to a year ago. The recent decline in sales can be attributed to rising construction costs and building material prices, with these increases then passed on to consumers, and to labor and supply chain challenges, which have extended homebuilding timelines, frustrating buyers and further aggravating America’s housing shortage.

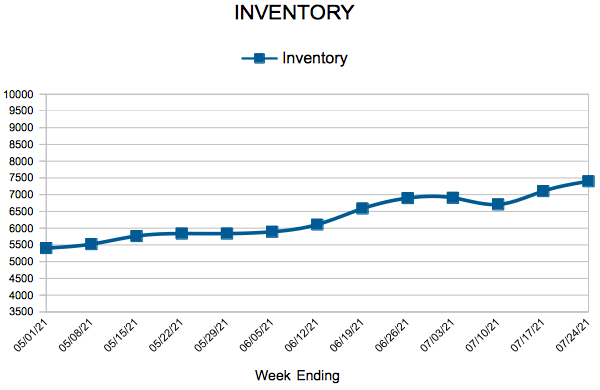

In the Twin Cities region, for the week ending July 24:

- New Listings decreased 3.3% to 1,786

- Pending Sales decreased 4.6% to 1,481

- Inventory decreased 25.9% to 7,400

For the month of June:

- Median Sales Price increased 14.8% to $350,000

- Days on Market decreased 52.4% to 20

- Percent of Original List Price Received increased 4.5% to 104.1%

- Months Supply of Homes For Sale decreased 42.9% to 1.2

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

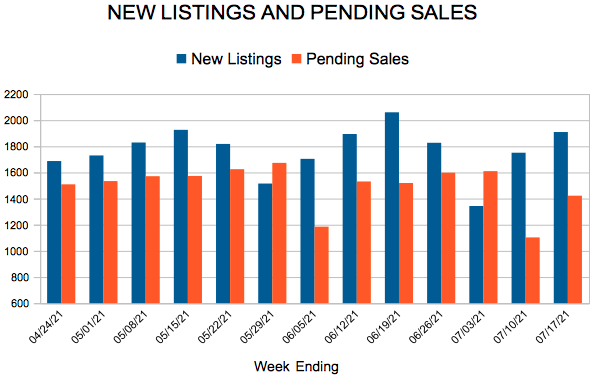

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending July 17, 2021

For Week Ending July 17, 2021

Cash buyers continue to make up a significant portion of the U.S. housing market, with nearly one-third of home sales this year being all-cash purchases. Although investors make up a considerable number of cash sales transactions, the increasing availability of remote work during the pandemic has allowed some homeowners to sell their homes in pricey markets and relocate to less-expensive locales, where they’re able to pay cash for a new home, giving them an edge in a highly competitive market.

In the Twin Cities region, for the week ending July 17:

- New Listings increased 3.1% to 1,909

- Pending Sales decreased 12.0% to 1,422

- Inventory decreased 29.0% to 7,106

For the month of June:

- Median Sales Price increased 14.8% to $350,000

- Days on Market decreased 52.4% to 20

- Percent of Original List Price Received increased 4.5% to 104.1%

- Months Supply of Homes For Sale decreased 42.9% to 1.2

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

June Monthly Skinny Video

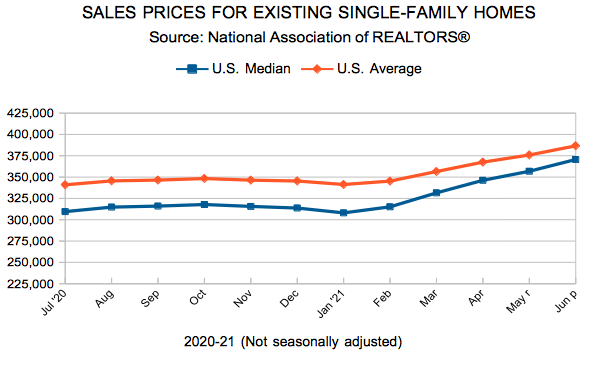

The increase in sales prices comes with a slight decline in existing home sales nationwide, as homebuyers struggle with declining affordability amid a lack of inventory, forcing some buyers to simply wait it out in hopes of more inventory and less competition.

Existing Home Sales

- « Previous Page

- 1

- …

- 85

- 86

- 87

- 88

- 89

- …

- 103

- Next Page »