Weekly Market Report

For Week Ending May 29, 2021

For Week Ending May 29, 2021

According to Black Knight, mortgage loan delinquency rates are continuing to decline, with the national delinquency rate falling to 4.66% in its April survey from 5.02% in March. While the continued decline of delinquency rates is a positive sign, nearly 1.8 million first-lien mortgages remain seriously delinquent, which is 1.3 million more than before the pandemic.

In the Twin Cities region, for the week ending May 29:

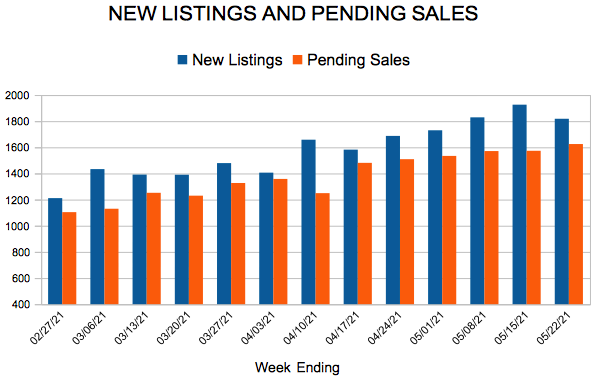

- New Listings increased 2.0% to 1,515

- Pending Sales increased 30.6% to 1,673

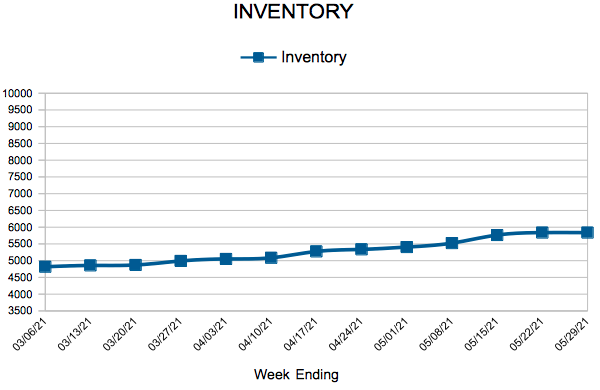

- Inventory decreased 45.4% to 5,837

For the month of April:

- Median Sales Price increased 10.2% to $336,250

- Days on Market decreased 34.0% to 31

- Percent of Original List Price Received increased 3.4% to 103.3%

- Months Supply of Homes For Sale decreased 47.6% to 1.1

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

New Listings and Pending Sales

Inventory

Weekly Market Report

For Week Ending May 22, 2021

For Week Ending May 22, 2021

A new analysis from Realtor.com® found that 20% of home sales nationwide in the first two months of this year were purchased in cash, up about 5% from a year ago. The substantial increase in cash buyers can be partially attributed to the competitiveness of the housing market, where a cash offer can help a buyer’s offer stand out from competing offers. Meanwhile, for buyers that do need to finance their purchase, mortgage rates on a 30-year fixed-rate mortgage averaged just 3% last week.

In the Twin Cities region, for the week ending May 22:

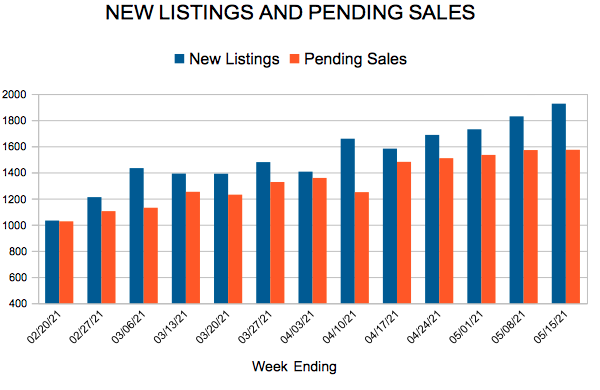

- New Listings increased 1.1% to 1,818

- Pending Sales increased 7.5% to 1,625

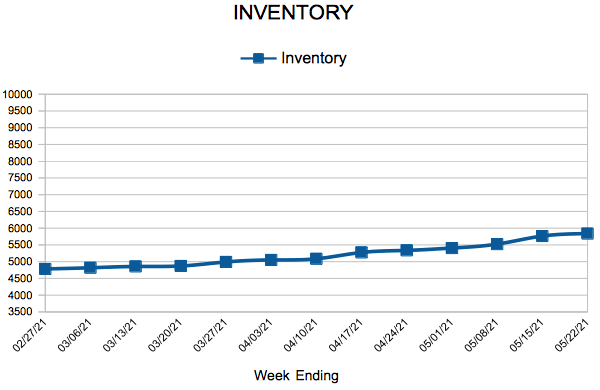

- Inventory decreased 45.1% to 5,838

For the month of April:

- Median Sales Price increased 10.4% to $336,845

- Days on Market decreased 34.0% to 31

- Percent of Original List Price Received increased 3.4% to 103.3%

- Months Supply of Homes For Sale decreased 52.4% to 1.0

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Mortgage Rates Drop Below Three Percent

May 27, 2021

Mortgage rates are down below three percent, continuing to offer many homeowners the potential to refinance and increase their monthly cash flow. In fact, homeowners who refinanced their 30-year fixed-rate mortgage in 2020 saved more than $2,800 dollars annually. Substantial opportunity continues to exist today, as nearly $2 trillion in conforming mortgages have the ability to refinance and reduce their interest rate by at least half a percentage point.

Information provided by Freddie Mac.

New Listings and Pending Sales

Inventory

Existing Home Sales

Weekly Market Report

For Week Ending May 15, 2021

For Week Ending May 15, 2021

Despite elevated demand for housing, construction of new homes fell in April, with the U.S. Department of Housing and Urban Development and the U.S. Census Bureau reporting a 9.5% decrease in housing starts from the previous month. Rising building costs continue to hinder affordability and inventory for many homebuyers, although shortages in labor, issues with the U.S. supply chain, and lasting impact from late winter storms have also contributed to the decline in new construction activity, putting some projects on pause for the time being.

In the Twin Cities region, for the week ending May 15:

- New Listings increased 13.8% to 1,926

- Pending Sales increased 13.5% to 1,573

- Inventory decreased 45.8% to 5,765

For the month of April:

- Median Sales Price increased 10.2% to $336,250

- Days on Market decreased 34.0% to 31

- Percent of Original List Price Received increased 3.4% to 103.3%

- Months Supply of Homes For Sale decreased 52.4% to 1.0

All comparisons are to 2020

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- …

- 88

- 89

- 90

- 91

- 92

- …

- 103

- Next Page »